Image taken from upcoming multiplayer game GigaBash from Malaysian studio Passion Republic Games

Southeast Asia is the third largest subregion in the world by population (650 million) and among the fastest growing game markets in the world. The industry report 2021 shows some interesting facts about the region.

The region of Southeast Asia has seen a stellar 440% growth since 2015, growing the industry from $1 billion to a $4,4 billion business (that is US dollars by the way). 70% of that money is made through mobile games and what’s even more interesting is that the regional industry for a large part caters to the local population. The market of active gamers in the region has grown from 126 million in 2014 to 255 million in 2020.

Started in 2003

Some interesting facts and figures from the report that researched the games industries in Malaysia, Indonesia, Vietnam, Singapore, Philippines and Thailand. The oldest still existing game company in the region is Game Square Interactive from Thailand (since 2003). From the surveyed companies almost half (48%) had less than 3 years experience. 22% of the companies have been around for more than 10 years. When compared to the 2015 report a large number of companies that were around then for 6 years or more have now disappeared, showing how difficult it is to sustain a game studio.

Most games are published on mobile (17% Google Play, 16% iOS) and Steam (18%). Popular monetization models in Southeast Asia are premium games (29%) followed by free-to-play (F2P) models generating revenue from In-Game Purchases (27%) and Advertising (21%).

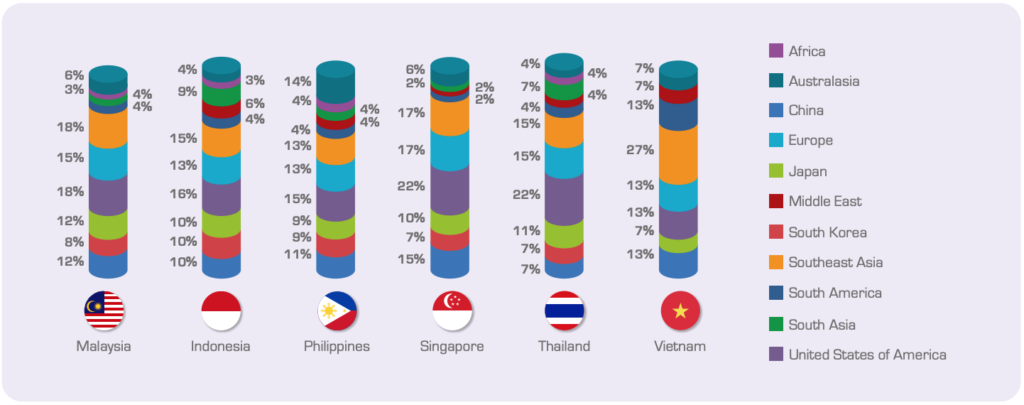

The top three target markets of Southeast Asian companies are the United States (18%), Southeast Asia (17%) and Europe (15%). The relatively large focus on the domestic market is in tandem with SEA as one of the world’s fastest growing game markets.

Small teams

The majority (50%) of gaming companies have an average of 1 to 5 team members per project. This is also due to the majority (48%) of game companies in Southeast Asia being start-ups with less than 3 years of experience. Big name game companies such as Ubisoft (Singapore) and Netease Games (Singapore) have more than 100 members per project, but that makes up only 2% of the total.

Services provided by game companies in Southeast Asia included planning (13%), pre-production (16%), production (21%), post-production (12%) and testing (10%). Findings showed that Vietnamese companies provided the most testing and planning services in SEA. Malaysia provides the highest pre-production services and is known as the original new IP games creation hub. Philippines game companies are usually involved in the production and postproduction of games due to its competitive labour cost. Singapore is known for pre-launch and launch game services.

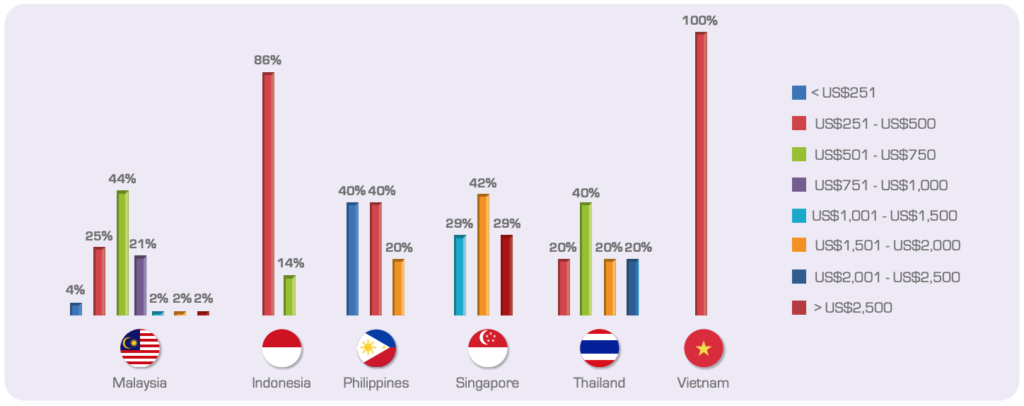

Rising wealth

Gopi Ganesalingam, Vice President of MDEC, a government agency that focuses on the growth of the Malaysian digital economy, knows why developers from Southeast Asia are increasingly looking at the domestic regional markets as an export destination: “Rising wealth and an increasing middle class, increasingly competitive internet pricing and faster broadband speeds all play a part. But the biggest part could be an ever increasing public sector support from the major countries in Southeast Asia of the digital content and creative sectors.”