Part 2 of an in depth look at blockchain gaming. Read part 1 here.

Blockchain technology presents both new affordances and constraints for game developers. Growth drivers center on a myriad of newly possible game play mechanics and related monetization strategies. It opens an additional layer that is meaningful to both players and creators.

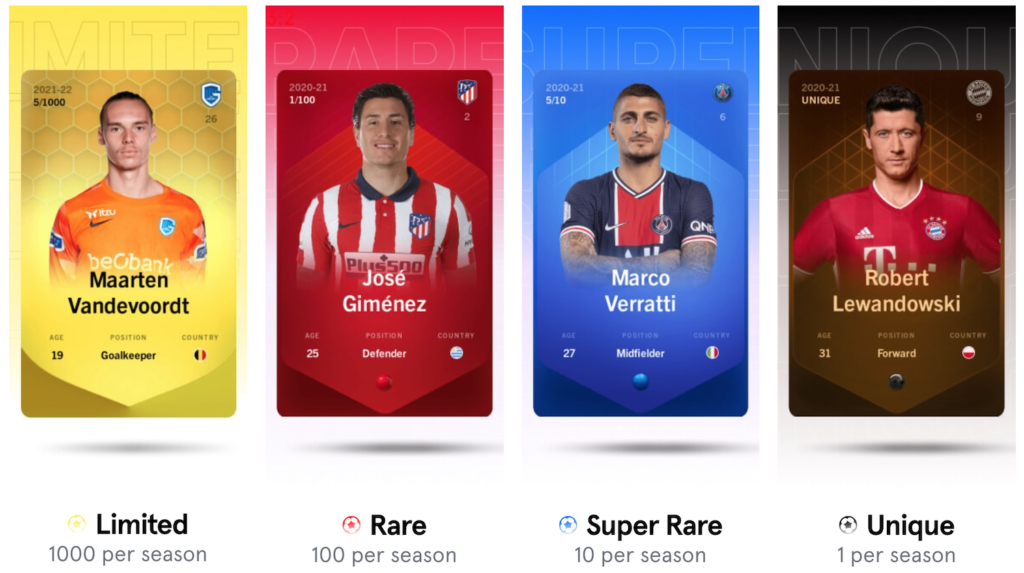

The ability to mint unique digital assets based on existing and new games needs little introduction. Today, digital is meaningful. A decade ago, microtransactions represented a small portion of overall sales and incurred little serious consideration. Today owning unique digital items is common because it allows players to both tailor their play experience (e.g., utility) and the representation of their digital selves in unique ways (e.g., vanity items).

A natural extension of NFTs is the emergence of secondary markets. Players can now easily trade their valuable collectible cards online. Blockchain technology facilitates smart contracts, which allow the original creator to earn a percentage from each subsequent sale. Previously unavailable, publishers are now able to establish a revenue stream based on the trading of in-game assets.

As a result novel games become more financially viable. According to Brian David-Marshall at Interpop:“Crypto allows you to sell the cards back. It simultaneously reduces uncertainty for the player, and offers a deeper meta game. Part of the game will revolve around knowing what cards will be good and which ones will be better following the introduction of new cards.”

Crossover items

A third affordance are NFTs that can be used and traded between different game universes, or so-called crossover items. It is, in effect, somewhat of a fantasy to bring the same unique, customized avatar to every different game you play. Imagine not just having the same username but an entirely personalized representation across games. But we have yet to see the emergence of a clear category leader, and the rapid growth spurt of the last year means that top blockchain game makers are struggling to roll out product, let alone collaborate. In an interview Sky Mavis co-founder Jeffrey Zirlin stated: “Right now everyone is still focused on making fun, workable products.”

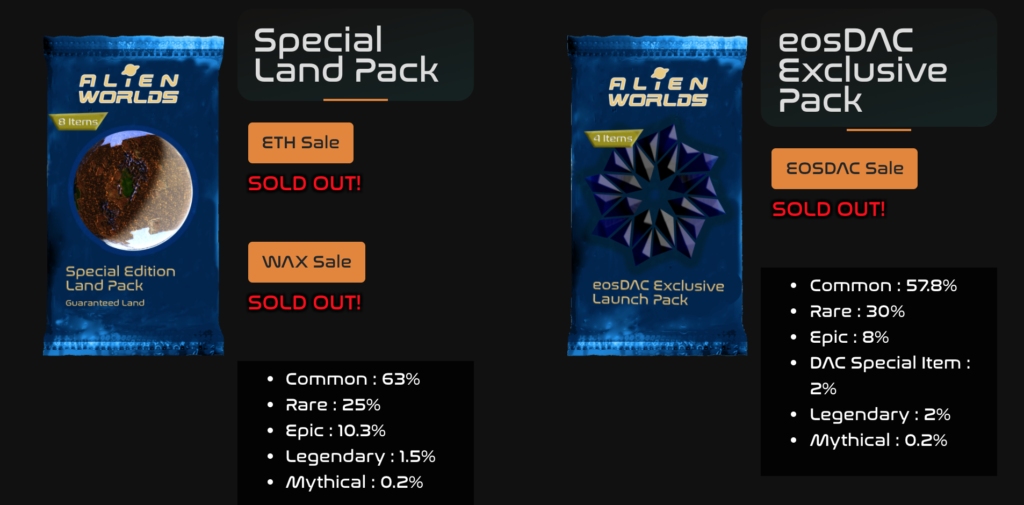

Selling in-game items pre-release to raise money for a project presents a fourth affordance. Tiered crowdfunding incentives easily translate into offering early investors unique digital assets. Going beyond individualized gifts and physical collectibles, blockchain facilitates the distribution of digital items and partial co-ownership of a game to early investors. It pushes what developers can do for their fans well beyond adding their names to the credits. In December 2020, Alien Worlds raised $250,000 by selling digital card packs. Three months later it raised an additional $2 million by selling its utility token Trillium.

Existing momentum seems to emerge from an echo-chamber as other crypto-based initiatives provide funding for others. Crypto-native firm Animoca Brands, for instance, led the March investment in Alien Worlds. For NFT-based crowdfunding to reach its potential it will need to attract non-endemic, generalist investors and mainstream consumers.

Virtual Real Estate

Closely related is virtual real estate. Selling parcels of virtual land presents an immediate revenue stream that appreciates over time as digital lots increase in value. It also offers a spatial connection between consumers and content. Decentraland, for instance, aims to facilitate “the creation of applications, distribute them to other users, and monetize them.” In effect, selling adjacent parcels using blockchain technology mimics conventional land ownership patterns where ‘districts’ guide traffic by clustering specific content categories together.

It is unclear still how, outside of benefitting from an early advantage, the literal incentive to buy virtual land to improve visibility is structurally different from paying a web 2.0 search engine or social network. As a virtual world’s popularity increases, the cost of entry will increase and prevent late-comers from access to more desirable assets and virtual locales. Consumers and content creators alike will move onto competing worlds where they, too, can be kings and queens.

By far the most popular and promising novel game mechanic to emerge from blockchain technology is play-to-earn. Simply put, players receive a monetary reward for their playtime. Their effort and success in a game can be transacted and exchanged for currency. Most notably, Axie Infinity offers a game in which players breed and battle Pokémon-like characters to upgrade their abilities. By trading their characters, players can earn crypto-currency which can then be converted to local currency.

Play to Earn

Following the pandemic, play-to-earn has proven especially popular in South East Asia (e.g., Philippines, Indonesia) where the economy has suffered and government support remains limited. According to Axie Infinity, around 42% of its player base comes from the region, compared to 8% from North America and 8% from Latin America from countries like Venezuela and Brazil.

It remains to be seen whether play-to-earn is an income equalizer, or a fancy rehash of the gold farming phenomenon. During the rapid popularization of MMOs in the mid-2000s, a rash of sweatshops emerged around titles like World of Warcraft where low wage workers leveled up characters to sell them to, mostly, wealthier players in western economies. In addition, the rapid popularity around play-to-earn also means that newcomers are quickly priced out of the market as the cost of participation increases.

Not all that glitters is crypto

What offsets the enthusiasm and emergence of cool new ways to play is the universal observation that technology generally changes more rapidly that social behavior.

One practical limitation is that it is mostly young and affluent people that show an interest or active use of bitcoin and crypto. According to study by Gartner, people aged 18 through 34 represent the largest consumer base (>60%) that indicates a positive interest in using bitcoin to pay for goods and services. And, assuming a median household income in 2021 of $79,900, there is a clear distinction in the overall awareness of bitcoin and cryptocurrency, and the interest in their usage. Currently higher income households ($75,000 and over) are 2.4x more likely (49%) to use bitcoin, compared to households earnings $75,000 and under (20%). It indicates that in to become mainstream, cryptocurrency will have to become more accessible and cater to a broader and more diverse consumer base.

Regulation is another inhibitor of infinite growth. With increasing regularity, the Chinese government has expressed concerns and confirmed a ban on cryptocurrency transactions. Local governments in key mining locations throughout China—provinces such as Xinjiang, Yunan, and Qinghai—announced plans to close down mining operations. In the United States, the Biden administration recently outlined its plan to raise an additional $700 billion through new tax measures. The plan states that cryptocurrencies pose “a significant detection problem by facilitating illegal activity.” The Treasury Department further announced that “transactions with a fair market value of more than $10,000” must be reported to the IRS.

Demand for chipsets

Next, the explosive demand for chipsets has left a shortage in supply. Ironically, it endows manufacturers with more power over an otherwise decentralized industry. NVIDIA, for example, recently expanding its mining limiter to RTX 3060 Ti, 3070, 3080 graphics cards. It also means that it takes longer to recoup the costs of a high-end processor. Chipsets will remain in limited supply as a result (since Ethereum is still predominantly mined on graphics), until its proposed shift to proof-of-stake over proof-of-work will cut the GPU requirements.

And, finally, following their popularization, the debate around the environmental impact of crypto-currencies has raised concern. According to a 2018 study, “cryptomining consumed more energy than mineral mining to produce an equivalent market value.” Currently, the energy expenditure remains modest: Bitcoin accounts for an estimated 0.30 percent of the world’s total electricity consumption.

A related consideration are ‘gas prices,’ referring to network transaction fees made by users to compensate for the computing energy required to process and validate transactions on the Ethereum blockchain. According to the Cambridge Center for Alternative Finance, the energy impact for Bitcoin is 72 Terawatt-hour compared to 28 for Ethereum, 0.000223 for WAX, and 0.00006 for Tezos. But as more companies and consumers adopt blockchain, the energy impact likely increases and more cost-effective protocols (e.g., Solana, Tezos) will grow in popularity among creative firms.

So where does that leave us?

The apparent irrationality of the current crypto craze is a necessarily messy stage in the evolution towards of a more stabile, decentralized future. Blockchain games are the literal playground where we experiment with, socialize, and discover the rules of a new technology.

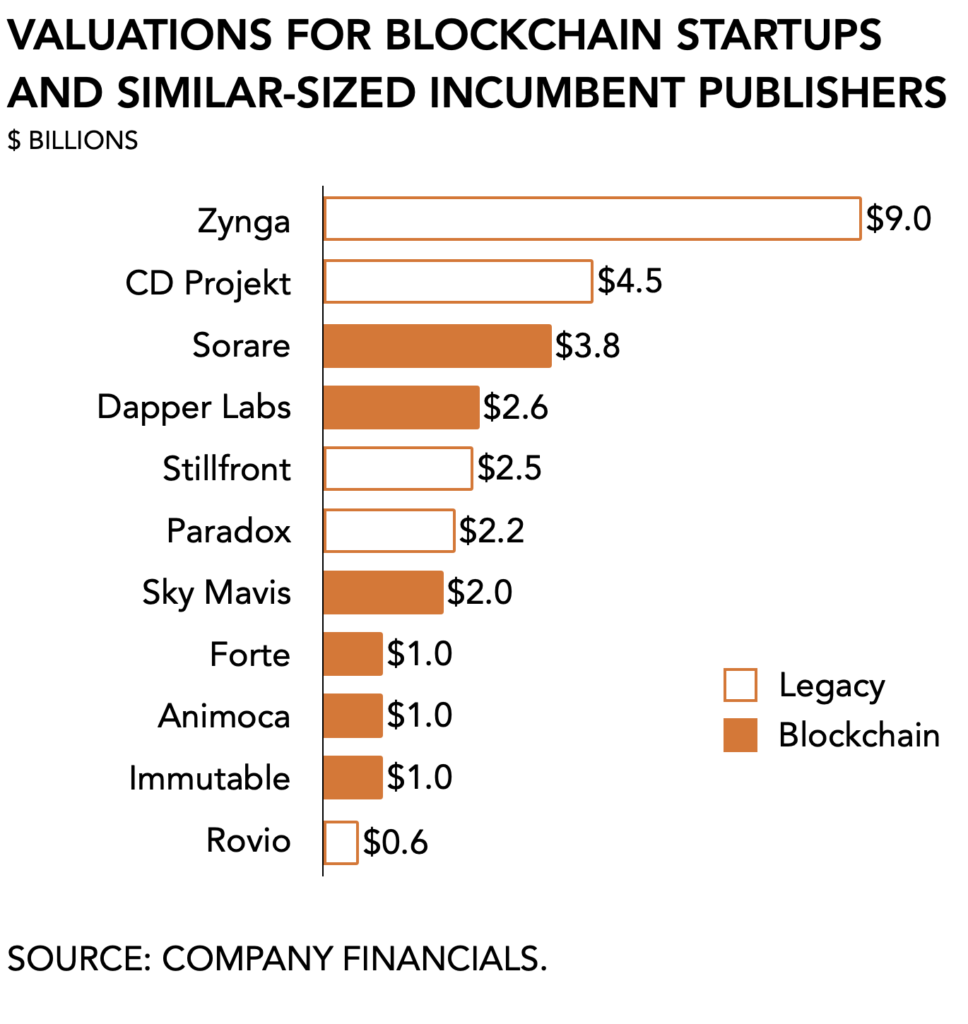

It results in some notable comparisons. The early successes and land-grab among venture capital firms have resulted in spectacular valuations. Still valued in the same subset of small and medium-sized game makers such as Rovio with a $600 million market cap and Zynga ($9.0 billion), blockchain gaming startups have a lot more to prove.

There are also no real apex predators. A new generation of creative firms confronts a promising new technology that offers experimentation and the formulation of novel game experiences. Legacy publishers are generally disincentivized to aggressively pursue a newly emerging space for two reasons: (1) unproven technologies or platforms can dilute the value of their existing franchises and intellectual property, and (2) the absence of critical mass means that margins will be low and therefore uninteresting.

But freedom generally comes at a cost. Without a central entity working to advance the growth and health of its ecosystem, developers will have to rely on different sources of capital (e.g., venture capital) and have fewer options with regards to platform subsidies and marketing alliances.

Clumsy multi-step process

The current influx of eager first-movers will change to hand-to-hand user acquisition tactics in time. This consumer vanguard that characterizes nascent markets, especially in entertainment, tends to be tech-savvy and comfortable taking risks and trying new technologies. The expected value increase in blockchain gaming comes from it breaching a broader audience. Here, barriers to entry remain high: users confront a clumsy multi-step process to create a game account, set up a specific wallet to buy crypto, and return to a game to start playing.

Already there are signs in the market that the initial growth spurt has resulted in an increasing complexity. According to Rafael Morado from Dapper Labs: “Today, all decentralized applications that want to reach over 10,000 users simultaneously have to rely on either a L2 solution, which usually sacrifices to some degree decentralization and transparency, or on a different blockchain from ETH.”

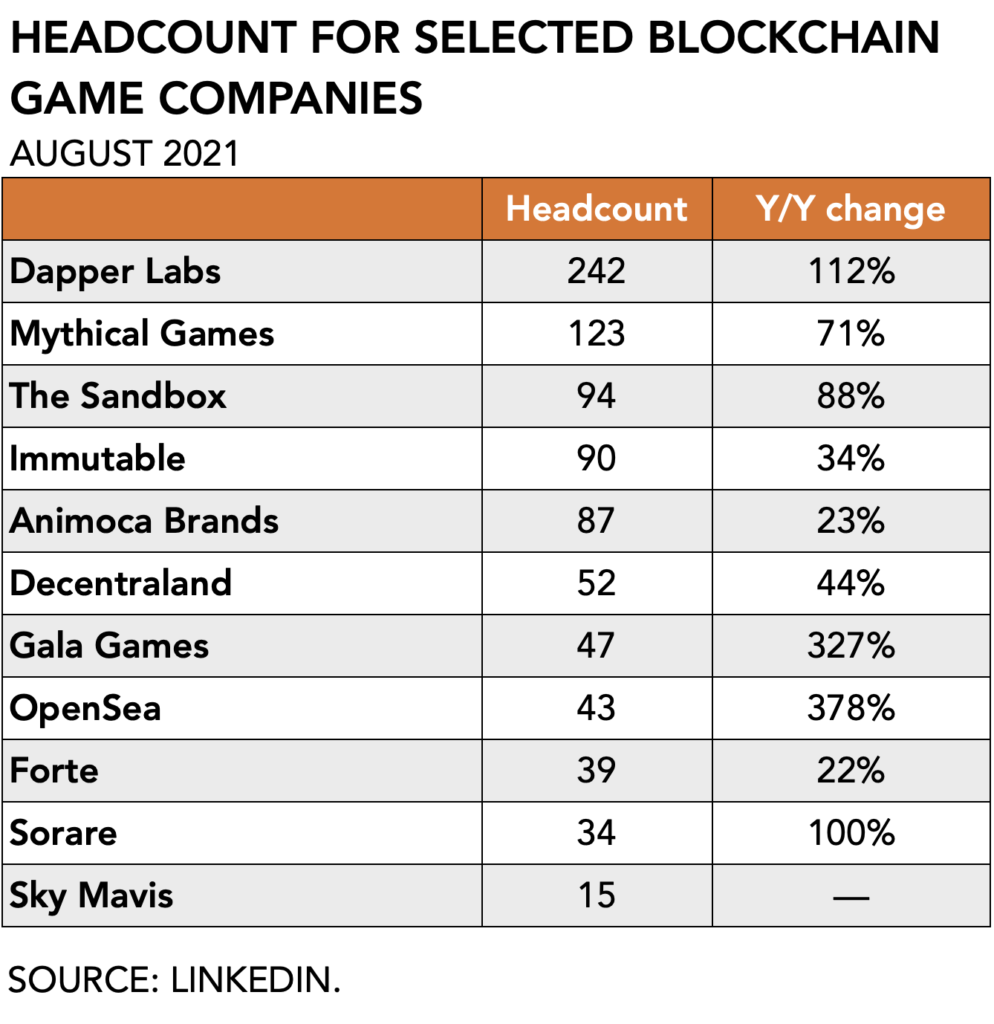

What all this activity boils down to is one simple observation: If you build it, they might come. But who is going to build it? Combined, the highest valued blockchain gaming firms are worth $9.4 billion and currently employ fewer than 500 people. Rapid growth means aggressive hiring. Across the firms that have made headlines in the past twelve months we observe a year-over-year increase of +102% in headcount. It tells you that talent is likely to become a major bottleneck in search of the killer app.

But even if these firms manage to rely for most of their activity on the positive outcome of being a fully decentralized autonomous organization (DAO), there is no substitute yet for talent and experience. In its current state, developing for blockchain technology is much more opaque and requires specialized skillsets (e.g., in-game economists). Abundant investment money will force firms to compete on hiring experienced developers, engineers, and producers in the short term. Even as their financial resources allow for acqui-hiring, top firms find it difficult to find staff.

It will be a while before blockchain gaming reaches its full potential and manages to disrupt the broader industry for interactive entertainment. That makes it a perfect target for investors and innovative creatives. For all its novelty, blockchain gaming adheres to many of the same principles that have driven success in entertainment: insert coin, press start.