Author David Kaye is co-founder and General Partner at F4 Fund. This article originally appeared on his Substack Game Stuff. Specialist VC firms that fund game development are a relatively new phenomenon. Most of them were started in the 2010s, and most of those in the latter half of the decade.

For our purposes, there are two important things to remember about the 2010s:

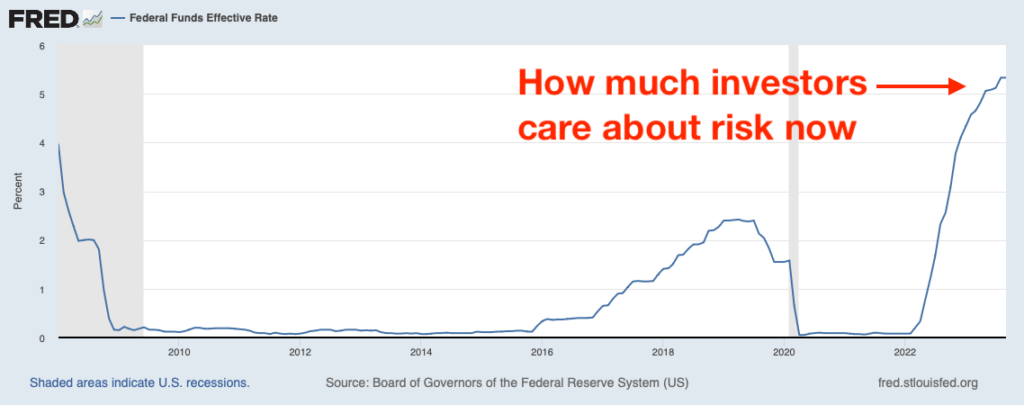

- It was a period dominated by low interest rates, which increased the risk appetite of all investors and allowed many new venture funds to raise capital.

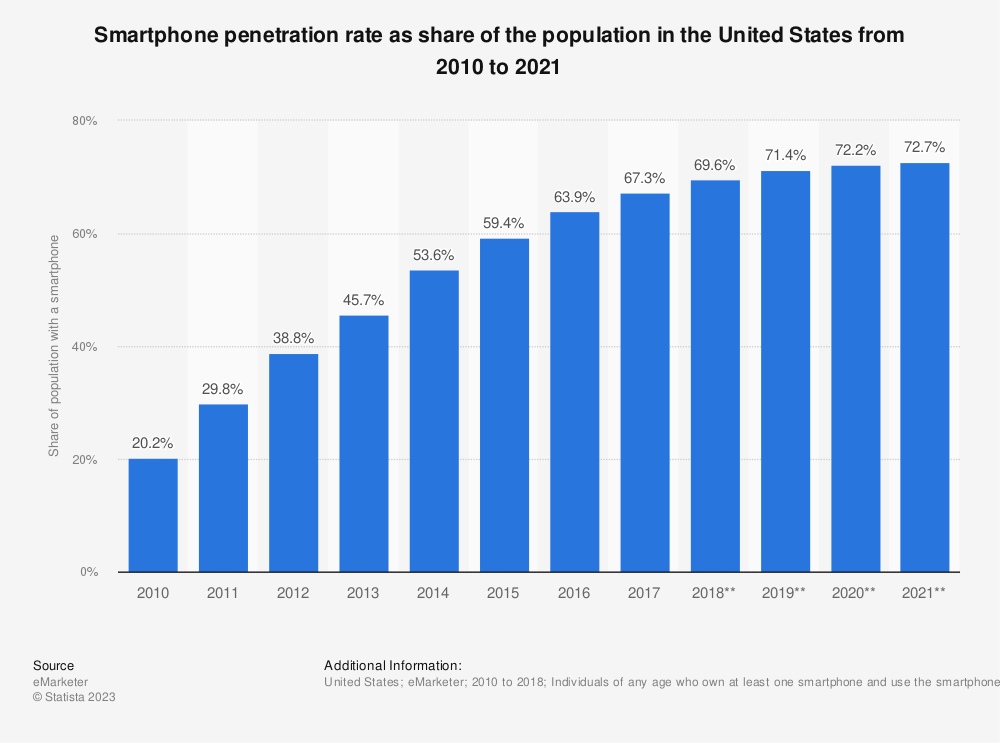

- The explosive growth of the smartphone.

Given these incredible tailwinds, it’s not surprising that mobile game companies have delivered the vast majority of gaming venture returns in recent years. But now the era of startup mobile gaming growth is over, as you can read here.

The 2020s: the post-mobile era arrives

Mobile gaming will continue to be a massive part of the industry, but since it’s likely that the majority of revenues will be captured by incumbents rather than startups, venture investors have started looking for new opportunities.

The two largest recipients of these flows in recent years have been:

- Web3 / crypto / blockchain games

- PC + console / Games-as-a-Service (GaaS)

I’m not going to talk about crypto, suffice to say that its prospects currently look about as bleak as SBF’s.

The pivot into PC and GaaS is more interesting. The success of Riot Games showed everyone that venture scale growth was still possible on PC, which some VCs appear to have taken as their cue to invest aggressively in former Riot employees turned founders. I have explored the wisdom of this elsewhere.

The problem with the PC pivot

One of the challenges of this pivot is that the PC market is also mature. When a platform matures, the following things tend to happen:

- Consumer expectations around content quality and polish go up.

- Games become more expensive to make.

- Incumbents who own popular IP and/or distribution have an advantage.

This doesn’t make large outcomes impossible – the open nature of the platform makes these more likely than in mobile – but it lacks the tailwinds that make venture scale growth easier to achieve. Put another way, platform maturity means increased content risk for investors, and startups have to get a lot more creative in finding ways to beat those odds.

The production demands of high fidelity PC development and the large funds raised by games VCs during the period of low interest rates have combined to produce a phenomenon I call the vertical slice seed round.

Pretty weird

The vertical slice seed round is usually the first money into the company, and ranges in size from $5M to $50M, with a median amount closer to $10M. The startup usually makes clear during fundraising that this will fund a vertical slice, but will not be enough to fully launch their product. There is a tacit agreement that if there’s good progress made, their lead investors will help to fund a Series A that will allow them to get to market.

I think a normal seed investor would look at this and find it pretty weird, because the main goal of any funding round is to significantly de-risk the next one. The usual way to do this is to build something, put it in front of customers and start iterating on product and go-to-market. If you don’t ship something with your seed funding, you’ve done a lot less to de-risk the next round than someone who has.

Investor appetite for risk has decreased as interest rates have risen and money has become more expensive. This is not just a vibes thing, nor is it unique to games – as Charles Hudson and others have recently noted, it’s playing out across the entire venture ecosystem as a huge drop in graduation rates from seed to Series A.

The storm

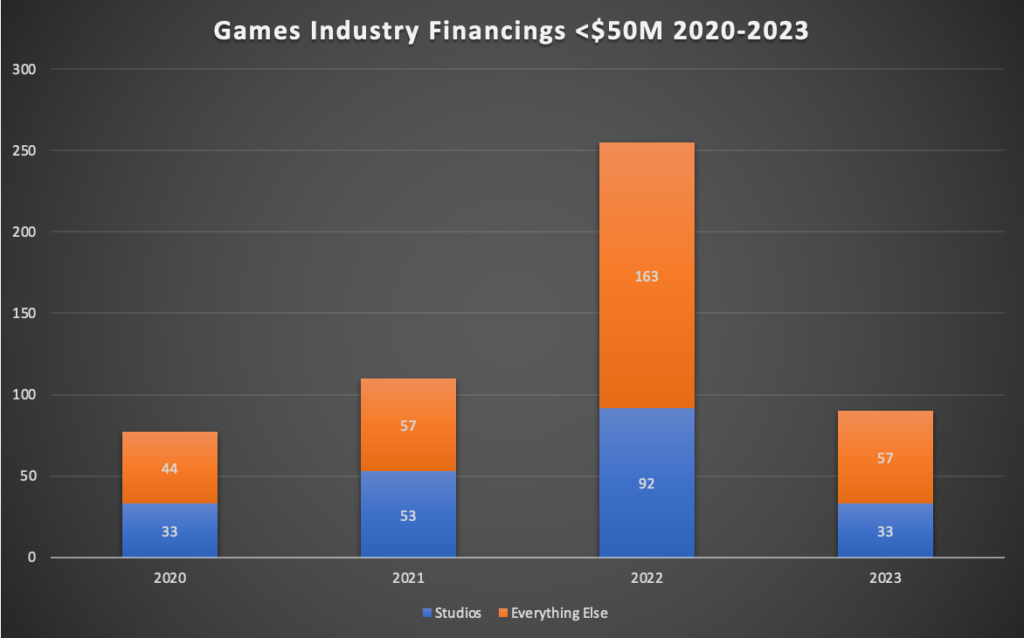

According to the best data I can find, roughly 500 game companies raised sub $50M rounds between 2020 and today (October 2023 at time of writing). Of these, about 211 were studios.

There are still VCs with dry powder, including multi-stage firms with large amounts to deploy. But most gaming funds are emerging managers, which is to say newer VCs who are on Fund I, II or III, as opposed to an established firm like Benchmark that is currently on Fund X or so.

Emerging managers are having a particularly hard time raising money right now, and that includes many gaming funds. They’re raising much less than they were originally aiming for, and it’s possible some may not be able to raise at all.

This is the heart of the storm: a huge mismatch between capital supply and demand.

Over the next 18-24 months, many of these startups will be coming back to raise the rest of what they need to get to market, and the results are not going to be pretty.

What happens next

There’s no way to sugar coat this: a lot of startups are going to die. The higher the company’s prior valuation and the more it raised, the higher the bar will be for its next round.

Here are some thoughts on what founders should do:

- Take a hard look at your runway and think about what you can do to extend it. “Do more with less” is too generic to be helpful, but do think carefully about scope, and embrace minimum viable fidelity wherever you can.

- Figure out how you are going to de-risk the next round for investors. Don’t bet the future of your company on a vertical slice – find ways to prove demand and experiment with go to market. Remember, you don’t need to fully ship a game to start creating intrigue and excitement around your IP.

- Look as broadly as possible for funding sources. In the boom times, VCs would counsel against taking on strategic investors too early, since their interests are not perfectly aligned. This is not a time to be picky. There are many sources of funding out there: strategic investors, publishers, platforms and subscription services to name a few. Leave no stone unturned. The truth is that most game companies are a better fit for publishers than they are for VCs, who are fundamentally in the moonshots business.

At the risk of stating the obvious: the more you can do during steps 1 and 2, the better your odds of creating options in step 3.

My partner Joakim Jachren has some good survival tips here too.

The next few years are going to be tough, but it is in times like this that the most formidable founders are forged. Good luck.