So called ‘idle tycoons’ are getting a lot of attention from the mobile game dev community lately. The balance between the seemingly simple production and potential yield make them an interesting genre. Many hypercasual game developers are now looking at more complex games with a higher Lifetime value (LTV) to battle the constantly increasing Cost Per Install (CPI).

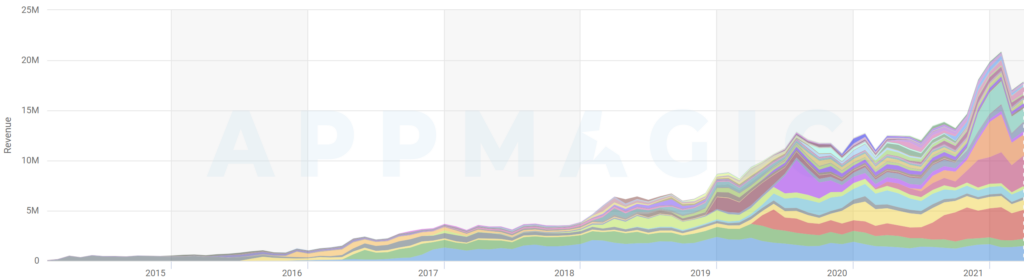

In 2022, cumulative monthly net iAP revenue of idle tycoons spiked and exceeded $21 million. Their cumulative revenue (including ad revenue) could hit the $30 million mark. AppMagic looks at some of the top grossing casual tycoons.

Top grossing tycoons

First let’s have a look at what’s going on with the cumulative revenue of idle tycoons, the scale, the dynamics and the diversity of the market. The graph below shows that the market has been growing steadily and quite fast during the last few years (click on the image to learn the details). There were several very strong titles that caused the growth of the market segment in 2021. The games are listed according to their revenues of Jan-Apr 2022.

#1: Gold & Goblins ($13.1 million net iAP revenue as of Jan-Apr 2022)

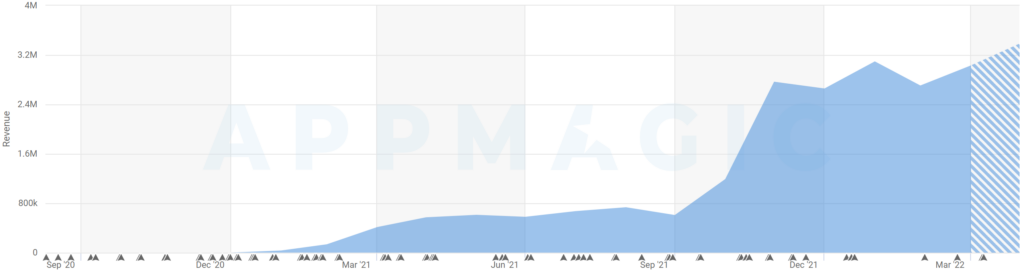

The game first appeared in stores in Sep 2020. The concept is quite innovative because of its distinctive direct control gameplay. Publisher AppQuantum explained that the game had a 50% Day 1 retention rate and a 10% for Day 30. It was developed by RedCell, a small Canadian studio with vast experience in development of Idle Tycoons. It goes to show that even a team of 3-5 people can develop a game of the same quality as Gold & Goblins, if they really know what to do.

A year after release, in autumn 2021, revenue of Gold & Goblins grew 4-fold. It went from $700.000 to $2.8 million in net iAP monthly revenue, and from $2 million to $8 million in total net monthly revenue (including ad monetization). Pretty impressive for a game that developed by a team of 3-5 people.

While RedCell works on the game, publisher AppQuantum is responsible for the business part. Compared to the small development team, many more people are involved on the publisher’s side. They work on monetization, user acquisition, marketing analytics, ad creatives, product analytics, elaborating live-ops ideas, ASO, store featuring nominations, etc.

#2: Idle Mafia ($11.5 million net iAP revenue as of Jan-Apr 2022)

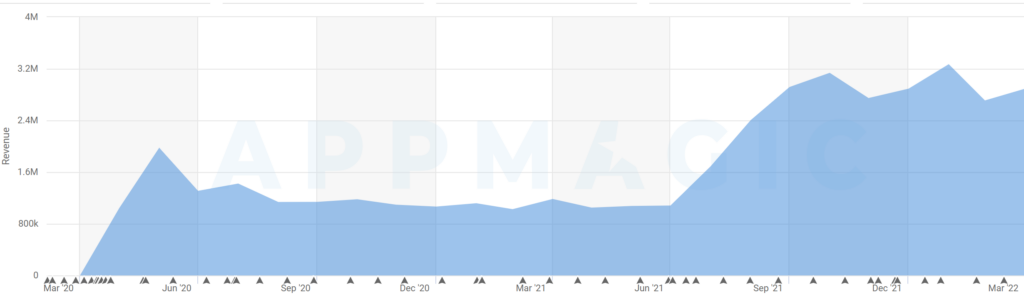

The game was released in March 2020. It really was an innovative title with the battler mechanics—essentially a simplified version of the party management mechanics seen in team battlers. A year after release, in summer 2021, Idle Mafia managed to grow nearly 3 times in monthly revenues.

There were several major app updates around the time of the revenue growth but it was probably the added social interaction mechanics that did the trick. Now the game is incredible rich with metagame and live-ops. The developers keep adding to the experience and that’s what keeps it alive and interesting.

Developer and publisher of the game Century Games Publishing is a very large and prosperous company. They operate some top revenue generating games: 4x strategies and farms. Their annual net revenue exceeds $550M. So their interest in idle tycoons (and Idle Mafia isn’t their only tycoon) adds points to the idea that games of this kind can earn a lot.

#3: Idle Lumber Empire ($10.3 million net iAP revenue Jan-Apr 2022)

In third place we find Idle Lumber, another tycoon of the new generation that contributes massively to the overall growth of the market segment. It’s notable in terms of its core mechanics. With depots attached to every craft shop—and different types of goods that the shops deliver. Idle Lumber isn’t the first or only idle tycoon that employs this mechanic but it does so very effectively.

#4: RuPaul’s Drag Race Superstar ($6.8 million net iAP revenue as of Jan-Apr 2022)

Based on the popular American reality competition tv series, in which presenter RuPaul searches for ‘America’s next drag superstar’. At its core, the game is a pretty conventional tycoon. The addition of a metagame in the form of an outfit battle mechanics, all in line with the IP, sets it apart. This game also contributed a lot to the cumulative revenue of the newly developed idle tycoons and to the whole market segment. Its monthly net revenue peaks at $2.5M in January 2022 (now down to $1.5M/mo).

Publisher Eastside Games uses well known TV- and movie IP a lot. The company has published several idle tycoons, and many of them are very successful: Trailer Park Boys, Archer, Always Sunny, and most recently Wizard of Oz.

#5: Idle Miner ($5.6 million net iAP revenue as of Jan-Apr 2022)

Idle Miner is the oldest top performer, released in June 2016. It has had a high and very stable performance during many years. The reason for this longevity is a very good base game and a lot of live-ops that appeal to the large and loyal audience.

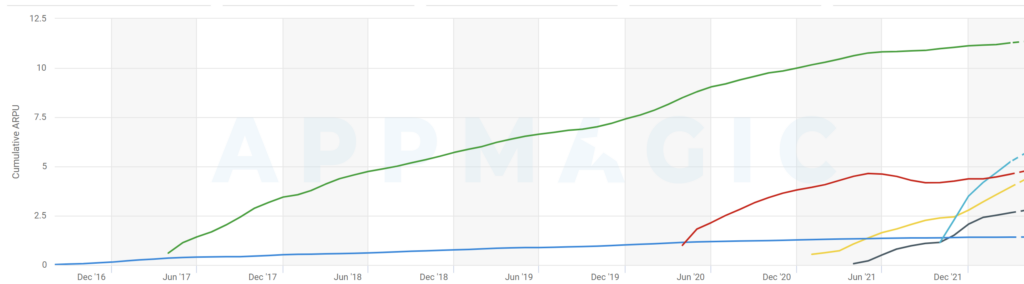

Players tend to stick to their favorite game and end up paying good money, especially if the title is based on a franchise. The graph below shows accumulated RpD (revenue per downloads ratio) over LT (lifetime of the game). It highlights the pace of ROI accumulation and gives some info about the lifetime of paying users.

When developers keep improving their game and the ability to monetize the audience, revenues can keep growing for years. Strong, stable growth usually signals that part of the long-living audience keeps on playing and paying. The LTV of an idle tycoon in the US may exceed $10.

Idle Miner publisher Kolibri Games registered the ‘idle tycoon’ trademark on Aug 29, 2019. They went after several idle tycoon developers because of trademark infringements. Kolibri registered 36 different trademarks with different possible names of games. We can expect more publishers to take similar action in the near future as part of the battle for traffic.

#10: Cats & Soup ($2.3 million net iAP revenue as of Jan-Apr 2022)

Cats & Soup is a special case. This game almost completely neglects the economic aspect of the tycoon games genre. It’s unnecessary to find details about different shops and upgrades because you have a big button in the UI that beckons you to ‘make the best possible investment’. So just tap it whenever you have enough money saved. A player has to place new ‘shops’ with cute busy cats in them. You can tap the cats to make them purr and enjoy watching the kitties dashing all around and having fun.

There’s no real sense of progress as you just keep developing the same world over and over again. This whole approach is quite rare for idle tycoons and games of this kind might define a separate sub-genre of idle tycoons.

#16: Law Empire Tycoon ($0.8 million net iAP revenue Jan-Apr 2022)

The last of the top performers is Law Empire Tycoon. It’s quite a sophisticated tycoon in terms of in-game economics. Users need to spend a fair amount of time to figure out how different production chains work and how to optimize them. This game also doesn’t have the mechanic that makes you constantly reset your progress. There’s no hyperinflation of the soft currency. There’s even no event locations. The game feels and plays a little bit like a regular PC version of a tycoon game.