Joakim Achrén helps founders build successful games companies. He’s investing in games through F4 Fund which he started in 2023, together with with David Kaye. To follow his work, subscribe to Elite Game Developers.

When Joakim Achrén posted on LinkedIn that founders shouldn’t take a market salary, and added: ‘If you need a high salary now, maybe startup life isn’t right for you, right now’, he ignited a fierce online discussion. Since the topic is nuanced, he wrote a more in-depth piece on the matter.

Let me share some background on my experiences. I was a founder from 2005 to 2019. I started by taking a 25K euro annual salary, which was after I’d raised outside funding. I always took a salary that paid the bills, and now as an investor, I believe in keeping founders and their families fed during the early years of the company.

As the years went on, I got more experienced and attracted more investor money. I could afford paying myself 40K euros annually. In my last startup, Next Games, my salary ranged from 30K to 90K euros, with the latter being what I earned after we’d IPOed.

Basic Rule

Here’s the basic rule when it comes to founder salaries: At the early stage, basically after your first round of financing, you cannot take a salary that goes beyond covering your costs. You want to break even.

Here’s what matters for hitting breakeven:

- Location (founder living in US versus Europe)

- Family situation (family or no family to support)

- Housing costs (paying a home financing loan)

- Other mandatory costs, including health insurance

Now, let me share what I’ve learned as an investor. Most investors I know ensure that the founder is comfortable. However, they will look into the salary expectations of founders before investing. It’s not acceptable if, a few months after the investment, the investor discovers that the founder is taking a $400K annual salary after raising a few million at pre-seed. If there are several co-founders all taking lavish salaries, the company will be dead in no time.

Here’s why the high salary is so tricky: it sets a dangerous precedent for paying high salaries to everyone before the company is successful and before there is any revenue. In this situation, the founder and investor often go their separate ways if a compromise isn’t found.

Why some founders get to pay themselves more

There’s an exception which I’ve often bumped into. If the company is perceived as a hot deal by investors, and many investors are fighting to lead your round, the founders can develop leverage. In this situation, founders get to pick their investors and set terms like founder compensation. Maybe they have been living a slightly expensive lifestyle, and the winning investor is fine with these terms. The market has priced the company, and since it’s of rare kind, the founder has much more salary flexibility.

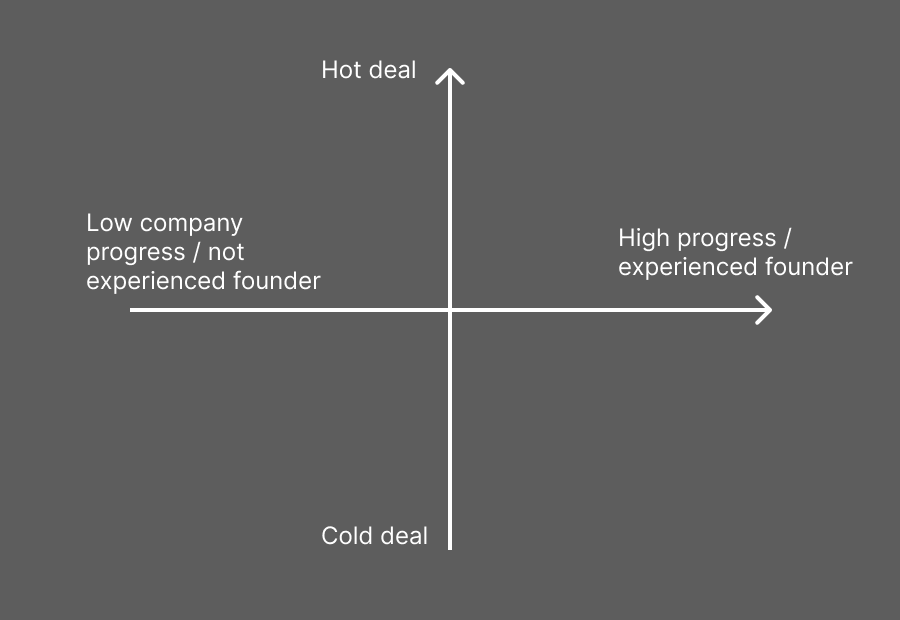

Let me break down how to think about early-stage founder salaries. Three key factors drive this:

First is company progress, typically measured in revenue or user engagement. Second is deal momentum – how many venture firms are competing to invest. Third is founder track record – repeat founders with successful exits often command higher salaries even at the earliest stages, as their experience itself is seen as a form of progress.

founders who land in the top right corner have the highest salary. The ones in the bottom left corner are on ramen.

Q&A on founder salaries

I asked a group of aspiring founders to send me their questions about salaries. Here’s what they wanted to know—and how I answered.

- “At what point can I start paying myself more than just survival money?”

It’s perfectly fine to pay yourself enough to cover your bills, as long as your runway can support it. As a bonus, openly discussing your salary with investors helps align expectations and build transparency. Most investors will be fine with covering your costs.

- “How do I explain my salary needs to investors without seeming greedy?”

There should be several discussions, and those discussions should happen before you sign the investment papers, so that everyone is on the same page of what compensations the founders are expecting. Be open, fair and transparent. You can share benchmarks from what other founders in your city and industry are getting at this stage; this will allow you to be more confident in these discussions.

- “What happens if my co-founder needs a higher salary than me due to family obligations?”

This is usually fine, but keep in mind that startups often take years to become profitable—sometimes five or more. If your co-founder consistently demands a higher salary during this time, they may not be suited for a startup journey. Set clear expectations early on: the path to success is long and tough, often requiring founders to cut costs and reduce their salaries to keep the company afloat.

- “Should I take a lower salary in exchange for retaining more founder equity after the round?”

If you think you can survive with a lower salary, it is a valid option. Just be sure to set clear expectations for when a salary increase will be necessary. Remember, the journey is long and hard.

- “How do investor expectations around founder salaries differ between the US and Europe?”

I think that modern VCs, both in Europe and US, think very much alike and they are investing in founders and their wellbeing.

- “How do I scale my salary as the company grows?”

A good approach is to revisit your salary with investors after each funding round. However, it’s wise to keep it modest and aligned with what other founders in your stage, location, and industry are earning.

- “How do I handle salary discussions when we’re a ‘hot’ company with multiple term sheets?”‘

Look at benchmarks from other high-profile startups by asking founders what they paid themselves after raising a mega pre-seed round. Use that data to justify your salary expectations to investors. That said, I’m not a big advocate for high founder salaries at the pre-seed stage—cash should be focused on growing the company, not funding a founder’s lavish lifestyle.

- “What should I do if an investor wants to dramatically cut my salary after investing?”

I’ve never seen this happen, and if it did, the investor would risk a major repetitional hit for attempting it.

- “How do I transition from a high corporate salary to a founder salary without destroying my finances?”

Having savings always helps. That’s what I did when I started my previous companies.

- “What are the red flags in founder salary discussions that might scare away investors?”

I always ask about founder salaries when evaluating an investment. A unnecessarily high salary with no clear justification can be a red flag—it suggests the founder prioritizes personal compensation over the company’s growth, especially at an early stage.

Final words

I mentioned market salary in my post. I think it’s great if founders talk to other founders who’ve raised funding and get a sense of what the market salary is for a founder at a similar stage. Don’t look at market salaries at big corporations or what kind of salary you earned working there. Don’t mix these apples and oranges. Benchmark what others are getting in your city or country, with a similar level of experience and progress, and go from there.