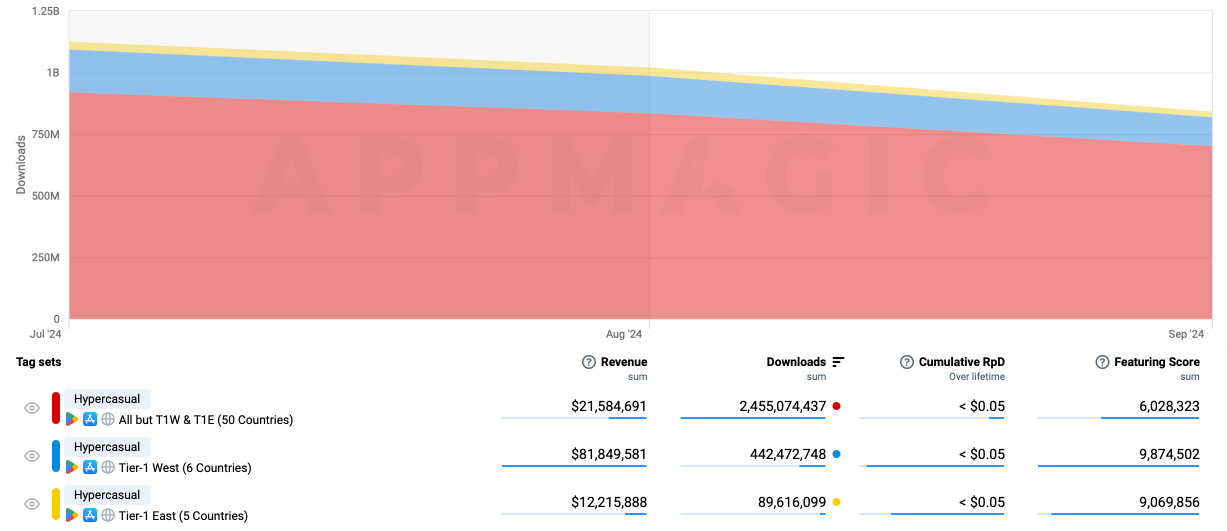

According to the AppMagic numbers, this quarter, the hypercasual games market shrunk by 12%—down to 2.98B total installs compared to the previous quarter. The case is about the same for YoY dynamics—the market went down by a similar percentage from its 3.4B downloads in Q3 2023.

The YoY dynamics are also comparable to the previous quarter: Tier-1 West faced the largest decrease at 18% YoY, followed by Tier-1 East with a 16% drop—and all other countries with their 7% slowdown.

This quarter, the trend has shifted slightly off the previous one, since all but Tier-1 West and Tier-1 East countries were accountable for the largest share of the quarterly market decrease: 11% (7 p.p. higher than Q2 2024). Tier-1 West downloads went down by 8% (1 p.p. lower than in Q2 2024) and Tier-1 East remained flat.

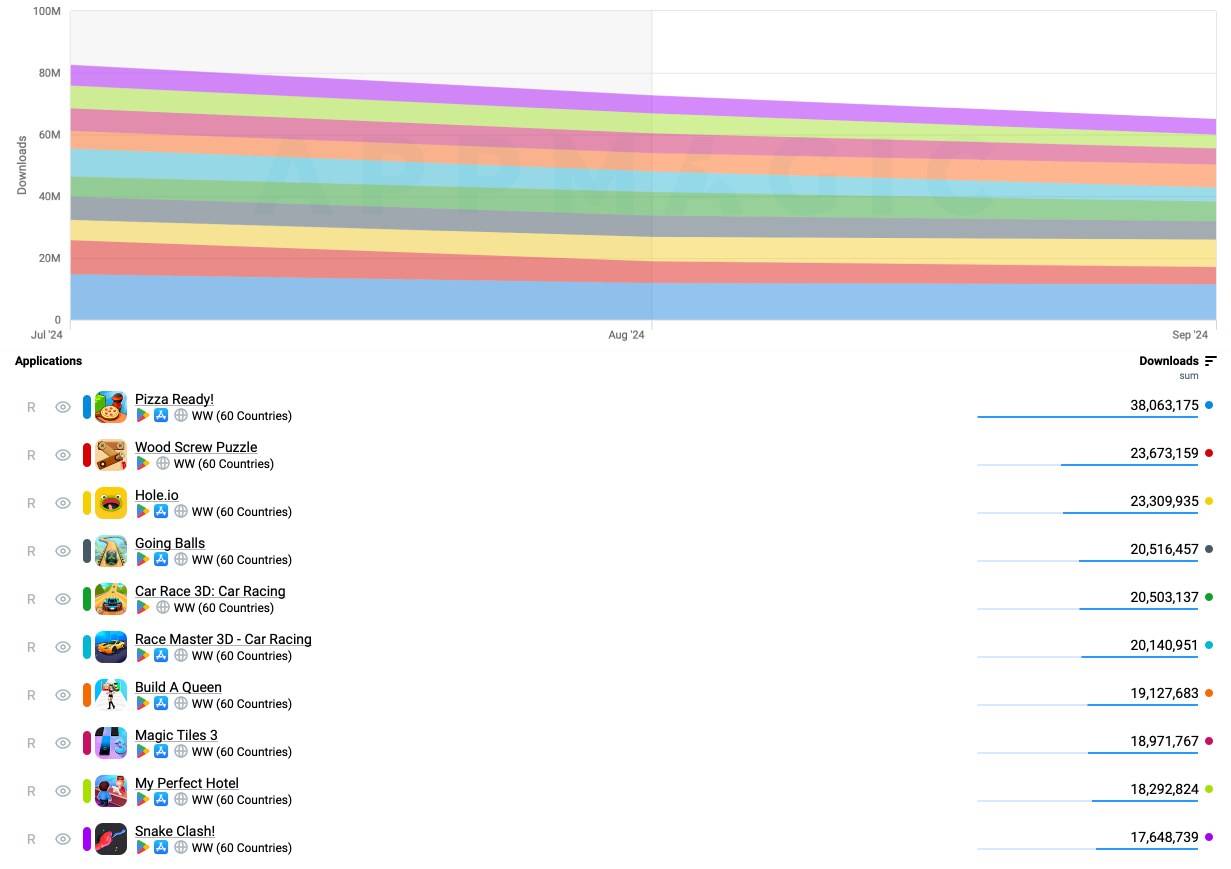

Top 10 Games By Downloads

At long last, moving on to the top 10 Hypercasual games by downloads in this quarter!

Traditionally, the majority of the top is composed of titles we’ve seen before, as well as a bunch of veterans, like Race Master 3D – Car Racing (31% QoQ), Build A Queen (–30% QoQ), Magic Tiles 3 (–14% QoQ), My Perfect Hotel (–14% QoQ), Going Balls (–9% QoQ), Car Race 3D: Car Racing (flat) and a few extra titles which are not letting go of their positions just yet, like Pizza Ready! (–40% QoQ) and Wood Screw Puzzle (–23% QoQ).

However, the number of newcomers is on a downtrend from quarter to quarter. This time, we only have two to cover.

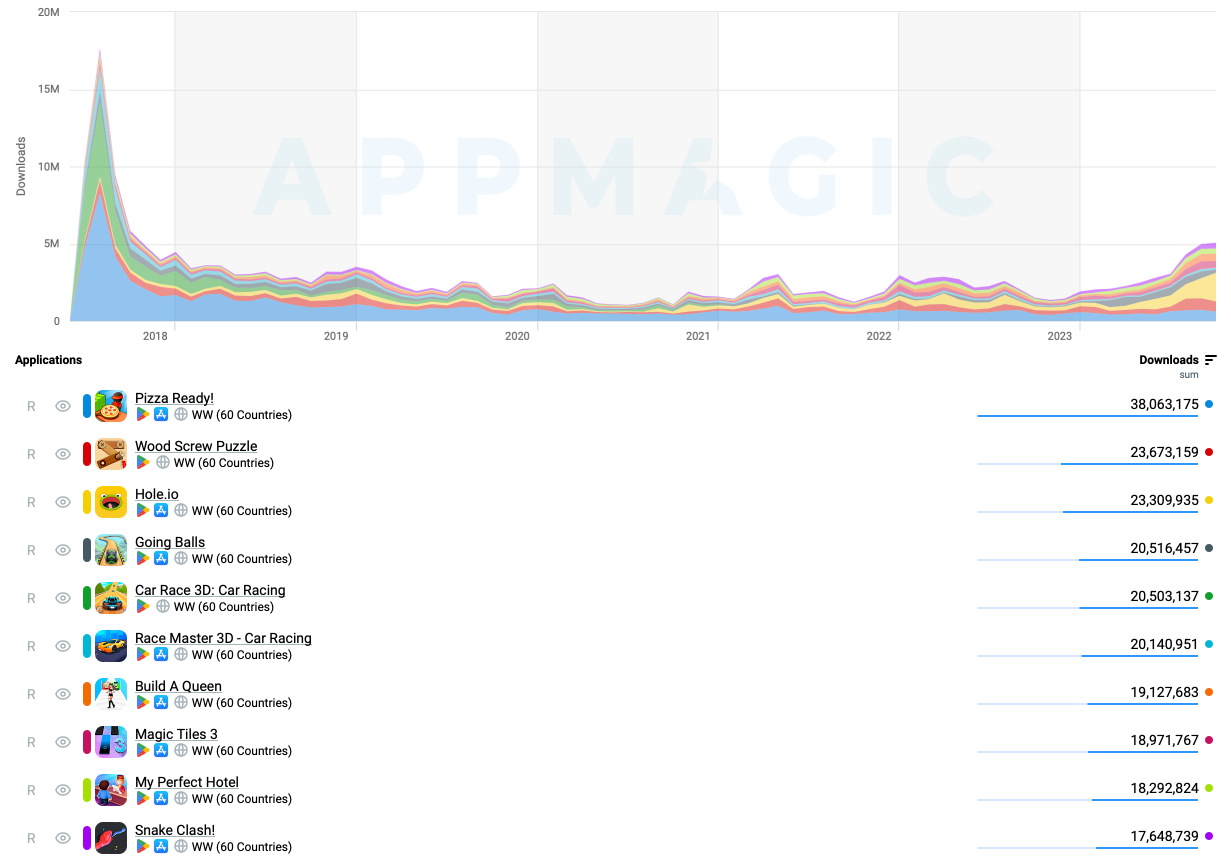

Hole.io

The first one up is the confident number 3 in the downloads top: Hole.io by VOODOO with 23M installs in Q3 2024. Interestingly enough, the game was released back in 2018, when it hit a decent 25M (!) monthly downloads at some point only to fall back and stagnate at 3 to 5M monthly installs for the next six years. This quarter, however, it picked the pace back up and has gotten to nearly 8M monthly downloads. As you can see from the graph, the figure is mainly driven by a rise in installs in India and Brazil, while the US market is staying level.

We asked Supercent about potential reasons for the title’s second wind, and our experts shared that the game actually pioneered the “Hole” genre back in the day. Clearly, the audience continues to love it still.

The concept is the following: players start with a small hole (or as one, if you wish) and grow by devouring objects smaller than their current size, as well as other players’ holes. The biggest advantage of this game is its variety of modes. There is a Regular mode where players must score as many points as possible within a time limit; a Battle mode where the last one standing wins; and an Endless Hole (Solo) mode where players can continuously expand the size of their hole. These modes allow players to pick and mix according to their preference, maintaining high retention and playtime. Additionally, players can try out over 40 different skins, and the content that allows them to earn rewards by collecting stickers enhances user satisfaction.

In terms of monetization strategy, the game includes rewarded videos, interstitial videos, and banner ads, along with various in-app purchase options. There is a subscription product that allows players to double all rewards and special in-app purchases for exclusive hole skins, increasing the game’s LTV.

Snake Clash!

Next in line is actually Supecent’s own game Snake Clash! with 18M downloads in Q3 2024. The title has also been on the market for some time now—since May 2023, and it has been continuously growing its monthly download figures from November 2023.

To make sure we’re objective on the maximum here, we decided to ask Anatoly Maximov to share his take on the game along with Supercent. The first thing he identified is the two approaches that Snake Clash! uses to engage first-time players and make their experience smooth, pulling them into the game at the expense of limiting their chances of losing from events beyond the player’s control:

- When colliding with stronger players or bots, the player is knocked back instead of ultimately failing, which prevents frustration and reduces the urge to quit the game.

- When a stronger snake bites a weaker one, only the bitten part is lost, avoiding immediate death that would have caused frustration otherwise.

Snake Clash! immediately sets clear goals for players on the main screen:

- The level name and objectives are displayed at the top. For example, at level 1, earning 1,200 points allows the player to defeat the boss and advance.

- The ranking table shows how earning certain levels rewards players with coins.

- Players can upgrade snake stats, such as speed and boosters, encouraging continued progression.

- Skins unlock gradually based on the number of games played.

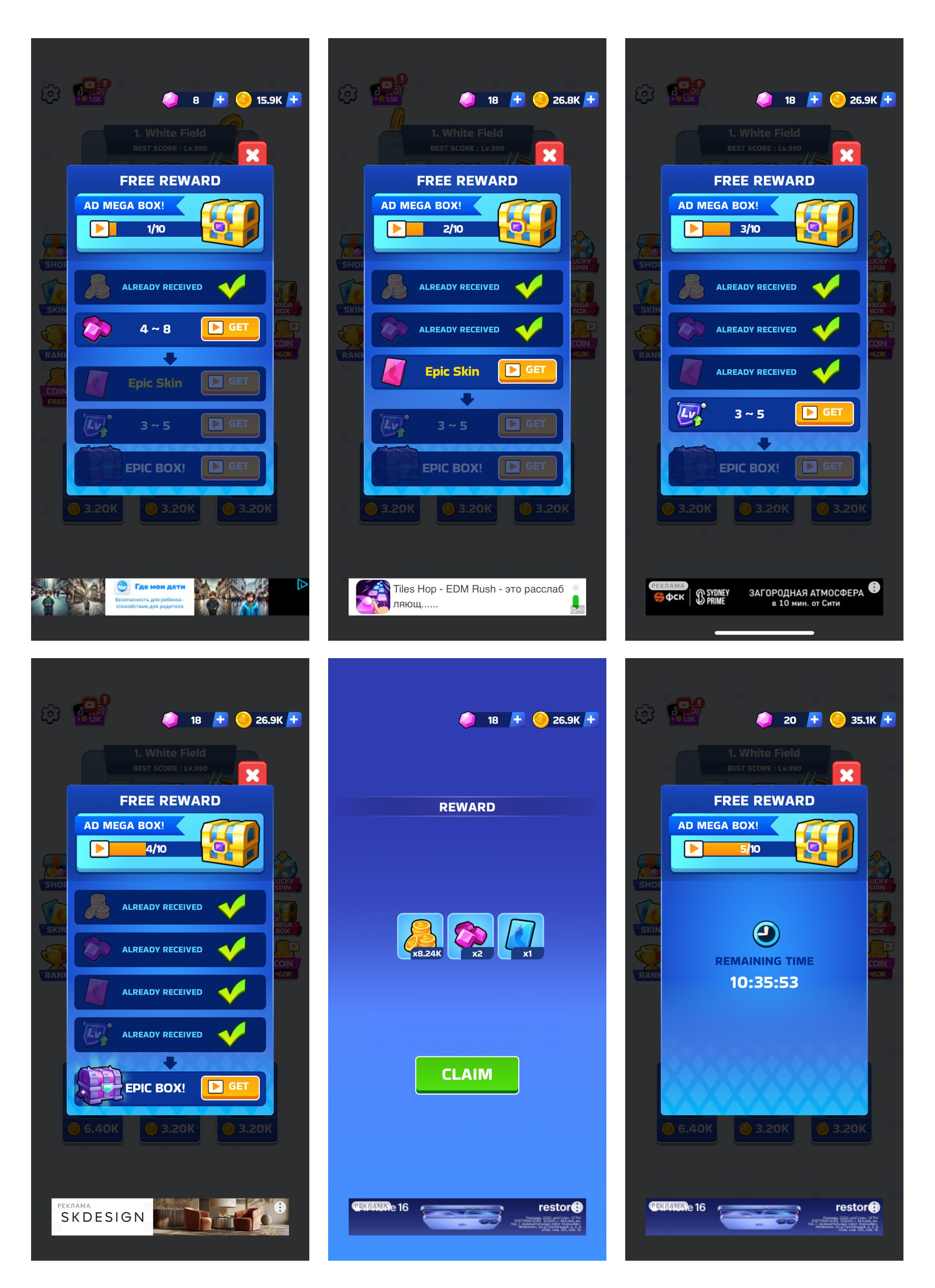

Monetization is introduced gradually, starting with free coins, then Mega Boxes, and later, a fortune wheel. In-app purchases seem priced higher than average for Hypercasual games.

Let’s look at the Mega Boxes quickly here. The player gets their 10 first rewards for free but must watch ads to unlock the rest. A progress bar, already 1/10 filled, encourages players to collect the remaining 9 rewards. After 5 rewards, a 10-hour timer kicks off, motivating players to return since they’re halfway there to claim that Mega Box.

This strategy mirrors the “Endowed Progress Effect,” demonstrated in an experiment where participants received loyalty cards. One group had to collect 8 stamps, while another needed 10 but started with 2 already filled. The second group was more likely to complete the task (34% vs. 19%), showing that even a small sense of progress makes people more motivated to put out toward the final goal.

Lastly, the snake design closely resembles Snake Run Race by Freeplay, a game with 71M installs. It seems that snakes with this kind of form have attracted the attention of players quite successfully in gaming creatives, having a positive impact on the game’s marketability.

Conclusion

Looking at the titles we already saw in the Q2 2024 report, we can easily see that most of the games are losing their installs, but are doing so at different rates. Pizza Ready! experienced the biggest drop and yet still delivered one of the largest monthly installs figures that we have seen in a long time. Where it is currently sitting at might be a sign of stabilization and an upcoming plateau for the title.

Among the newcomers in the top 10 by downloads, we continue to notice the audience’s tendency to go back to the games they used to love several years ago. This time, one of the driving factors was the focus on boosting downloads in regions that were among the top 5 but had considerably fewer installs than the leading region. Another aspect that had an impact on player engagement was the opportunity to choose between various play modes and skins, providing a certain level of customization.

The second newcomer in the top ranking highlighted the importance of the sticky factor, which was cultivated by limiting the number of ways for the player to lose due to events beyond their control, as well as by gradually introducing monetization and leveraging the psychological effect of a specific progress bar approach to keep players playing and the trends trending.

Author: Diana Levintova – AppMagic