Joost van Dreunen argues there’s a deeper, cyclical pattern that explains why interactive entertainment has entered a down period. He says that innovation cycles shape the industry's direction more than technological prowess alone. Enter the Play Pendium Theory.After speaking with a broad range of decision-makers, executives, and creatives over the past several months, I’ve identified a partial explanation for the paradox of an immensely successful yet tumultuous video game industry. Amid the current transition, even the largest, seemingly impervious incumbents are changing how they plan to operate in the future. As such, it makes sense to see if we can identify a broader macro-economic pattern. Enter the Play Pendulum.

Succinctly, the Play Pendulum theory suggests that the video game industry alternates between two primary types of innovation: content innovation and distribution innovation. Each cycle typically lasts about a decade and directly shapes how games are created, distributed, and consumed. Understanding this pattern, I believe, provides insight into the industry’s past, present, and potential future. With this framework in mind, we can explore how different eras of the industry have oscillated between content and distribution innovation.

I’ll start by defining these two types of innovation:

- Content innovation periods are characterized by a focus on developing new types of games, expanding game portfolios, and pushing the boundaries of gameplay mechanics and storytelling. During these times, demand is strong and self-sustaining, leading to increased investment in content development and acquisitions as firms pursue economies of scale.

- Distribution innovation periods, on the other hand, focus on finding new ways to deliver games to players and generate revenue. This might involve the introduction of new platforms, novel distribution methods, or innovative monetization models. During these phases, industry growth is less certain, and companies focus on improving efficiency and expanding market reach.

A visualization of annual consumer spending on interactive entertainment, alongside key industry events, illustrates these shifts.

The Atari/Nintendo era: 1975 to 1993

The first major swing of the Play Pendulum covers the early years of the video game industry. This period saw the birth of the industry, its first major crash, and subsequent revival.

The content innovation phase lasted from 1975 to 1983. Atari led the charge, creating new types of games for home consoles. Games like Pong, Asteroids, and Space Invaders weren’t just technical achievements; they represented entirely new forms of play. Atari’s strategy centered on creating a wide variety of games, emphasizing the abundance of titles available for their consoles. This approach initially proved successful, with Atari’s console sales growing from 250,000 units in 1977 to 4 million units annually in 1981 and 1982.

However, a solipsistic focus on content creation led to challenges. Overconfidence in market demand resulted in significant miscalculations. For instance, Atari ordered 12 million units of Pac-Man in 1982, expecting to expand beyond their 10 million console install base. It only sold 7 million copies. Within two years, the market became saturated with undifferentiated content as over 100 third-party developers rushed in. These factors, combined with rising development costs and a lack of quality control, culminated in the industry’s crash in 1983.

Following, the pendulum swung towards distribution innovation from 1984 to 1993. Nintendo emerged with a radically different approach, focusing on creating a carefully curated ecosystem that prioritized quality control and value creation. Its strict licensing program for third-party developers imposed rigorous quality standards and limited the number of games a developer could release annually. Nintendo also revolutionized distribution by offering innovative terms to retailers, allowing stores to stock games without upfront payment and only charging for units sold.

The emphasis on distribution innovation revitalized the industry. The market recovered from its low point following the crash, growing from $429 million in 1985 to $5.8 billion in 1993. Nintendo’s approach ensured a consistent level of quality across its game library and helped rebuild consumer trust in the industry.

Digitalization and smartphones: 1994 to 2015

The second major swing of the Play Pendulum encompassed the rise of 3D gaming, the emergence of online multiplayer, and the mobile gaming revolution.

The content innovation phase lasted from 1994 to 2003. It began with Sony’s entry into the gaming market with the PlayStation, which raised the bar for quality and performance. The advent of 3D graphics led to revolutionary games like Super Mario 64 and Tomb Raider. During this period, the total market more than tripled from $5.8 billion in 1994 to $24.5 billion in 2003.

Large publishers like Electronic Arts embarked on significant acquisition sprees during this time. EA’s strategy focused heavily on developing and acquiring new intellectual properties. In 2002 alone, EA released 58 titles. Their focus on content innovation was reflected in their financial performance, with total revenues growing from $492 million in 1994 to $2.8 billion in 2003.

Naturally, this approach came with novel challenges. Development costs at the time for new, top-tier games averaged around $10 million, with next-generation titles costing double that amount. However, game prices were not seeing a corresponding increase. The average sales price for a game fell to around $33, indicating a surplus in supply.

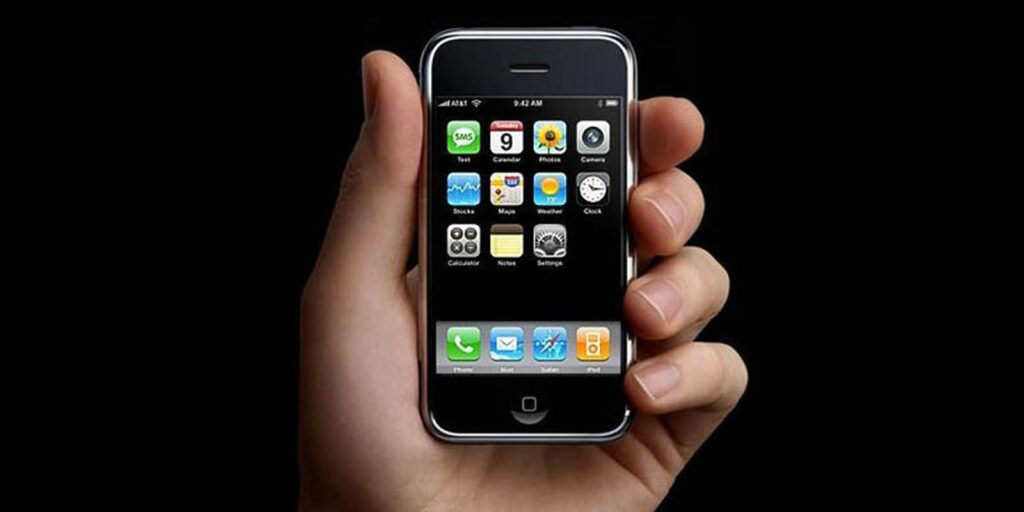

The pendulum swung back to distribution innovation from 2004 to 2015. This period saw the rise of social gaming, mobile gaming, and digital distribution platforms. Key events during this phase included the launch of Valve’s Steam platform, the release of World of Warcraft, and the rise of smartphone-based gaming following the introduction of the iPhone in 2007 and the App Store in 2008.

Steam revolutionized game distribution by offering a 70/30 revenue split and eliminating the need for costly console certification or physical retail processes. Within a decade, small and midsize studios were releasing around 1,500 new titles annually via Steam. Today, the platform sees the release of almost 15,000 new titles each year.

World of Warcraft introduced a subscription-based model that was unprecedented in scale for Western markets. Initially hoping for 400,000 subscribers in its first year, the game reached that number within the first month. By 2010, it had peaked at 12.1 million subscribers, each paying a monthly fee. Its push into a new distribution model proved a brilliant success.

During this period, a new breed of game companies rose to prominence. Companies like Nexon successfully entered the US market with games like MapleStory, overcoming challenges related to broadband penetration and payment methods. Nexon’s revenues grew from $650,000 in 2005 to $29 million in 2007, primarily through innovative distribution and payment strategies.

And finally, mobile gaming further transformed the industry. After the introduction of the iPhone, it took Apple a few years to finally embrace free-to-play monetization, thereby lowering the entry barriers to its growing user base. It opened the door also for several notable newcomers that would come to dominate the industry. As a result, from 1994 through 2015, overall consumer spending on interactive entertainment grew dramatically, from $5.8 billion to $104 billion.

2016 to present

The most recent phase began with Activision Blizzard’s acquisition of King Digital Entertainment in 2016, signaling an industry-wide push into mobile and casual gaming. This period has seen the rise of battle royale games, live service games, and an increased focus on user-generated content.

Accelerated and truncated by the pandemic, the content innovation phase lasted from 2016 to 2023. A spectacular rise in demand for interactive entertainment resulted in the success of several notable newcomers. Epic Games, for instance, established itself among the top publishers by re-tooling its Fortnite title to include battle royale gameplay.

During this period, online play became the standard as audiences began spending more time playing and socializing online. The ability to play with others regardless of device type connected gamers to a single global audience. Microsoft made several significant acquisitions during this time, including Mojang (Minecraft) in 2014, Bethesda in 2021, and Activision Blizzard in 2023.

The COVID-19 pandemic accelerated demand and provided the cheap capital that enabled a string of acquisitions across the industry. The drive for economies of scale had returned.

To illustrate the dramatic industry consolidation during this period, consider that in 2023, the ten largest game companies accounted for 65 percent of the global games market, up from 58 percent in 2020. Over a decade, the combined revenue generated by the ten largest game companies increased from $45.4 billion in 2014 to $157.9 billion in 2023, more than tripling.

However, as with previous cycles, the risks of overextension became apparent. Take-Two Interactive’s $12.7 billion acquisition of Zynga in 2022, while strategic, led to an immediate decline in the company’s value. Similarly, Microsoft’s $68.7 billion acquisition of Activision Blizzard in 2022 coincided with Candy Crush being dethroned for the first time in 22 consecutive quarters, highlighting the challenges of maintaining dominance in the fast-paced mobile market.

Most recently, the pendulum appears to be swinging back towards distribution innovation in 2024. This shift is marked by events such as the release of the Super Mario Bros. Movie and the introduction of creator tools for two of the most popular games. Hollywood has moved to capitalize on the broader appetite for gaming IP-based film productions, establishing new distribution channels and revenue models for game companies.

The introduction of the Unreal Editor for Fortnite (UEFN) and the Roblox Economy signaled a change in how even major publishers were going to develop content and monetize their audiences. Despite their commercial success in previous years, both Epic Games and Roblox declared that user-generated content was to be a central component of their future success. Along this same line of thinking, the largest independent US publisher, Electronic Arts, recently announced a creator program for its popular franchise The Sims, as part of a renewed growth strategy.

Market concentration and the Play Pendulum

The oscillating focus on different strategic innovations also manifests itself in changes in market structure. As firms pursue economies of scale during content innovation phases, we see market consolidation increase. However, distribution innovation phases often lead to decreased market concentration as new entrants find opportunities in novel distribution methods.

Data on market concentration reveals these trends. In the early 1980s, Atari commanded the lion’s share of consumer spending. However such rapid growth put enormous strain on the organization’s operational efficacy, ultimately leading to a decline in the quality of the user experience and the industry crash.

After Nintendo rejuvenated the market, other contenders presented themselves. Sega released its Genesis console in 1989, and Sony launched the PlayStation in 1994. Overall concentration in the console market initially declined but remained relatively high throughout the years that followed as publishers began to bulk up on intellectual property.

Looking at the combined market share of the four largest firms in each market segment (PC, console, and mobile) reveals interesting trends. During the first period up until the late 1990s, the global games industry was heavily concentrated, with the combined market share of the four largest firms hovering around 100%. This gradually tapered off as more market participants emerged.

The introduction of Steam by Valve in 2003 marked a significant shift. It attracted newcomers, and concentration in the PC category promptly dropped. Similarly, the emergence of social network-based gaming on Facebook and the rise of mobile gaming triggered a gold rush among creatives, further decreasing market concentration.

However, as saturation set in during the most recent content innovation phase, large game makers recognized the need to capture market share through acquisition. This has led to increased market concentration once again, as evidenced by the growing market share of the largest firms.

Financial downturns and the Play Pendulum

Interestingly, financial downturns often precede and coincide with shifts from content to distribution innovation. For instance, just before the collapse of the video game industry in 1983, the United States had suffered an economic downturn. This happened again in 2008, just before the smartphone emerged as the dominant platform, and again in 2023 after the financial momentum of the pandemic had died down. It is in part why the games industry has generally been considered counter-cyclical and more-or-less impervious to economic downturns.

While establishing direct causality between financial declines and shifting innovation focus is beyond the scope of this analysis, the regularity of this coincidence suggests they are at least simultaneously occurring phenomena. These downturns often coincide with a shift from scale focus to efficiency, and a move from volume to value in game development and consumption.

Final thoughts

The Play Pendulum offers a framework for understanding the cyclical nature of innovation in the video game industry. By recognizing whether the industry is in a content or distribution innovation phase, companies can better position themselves for success.

However, it’s important to note the limitations of this theory. For one, as a theoretical model, it is a simplification of complex industry dynamics. It proposes two primary types of innovation and there are likely other crucial factors influencing the market. While it provides a framework for understanding general trends, forecasting specific innovations or market shifts remains challenging due to the industry’s rapid pace of change.

Nevertheless, I’ve found the Play Pendulum a useful tool in my conversations with a host of different firms for understanding broad industry trends. Moving forward, companies that adapt to the Play Pendulum’s swings will be best positioned to thrive.

Now, with the pendulum appearing to swing back toward distribution innovation, we stand at the precipice of a new era. Will emerging platforms redefine how we access and experience games? Will new monetization models rewrite the rules of engagement between creators and consumers? And perhaps most crucially, which companies will seize this moment to redefine the industry’s future?

All images Wallpaper Acces.