The crew at ALDORA and Joost van Dreunen have put together their annual market forecast. Here are some of the highlights. It’s been a rough ride across the industry, to be sure. Layoffs continue to haunt everyone as game makers collectively focus on efficiency and profitability in an effort to stay alive long enough to make it to 2025. The long-term implications of this bloodletting will show themselves soon enough. A growing share of people in my network are swapping their corporate jobs for startup life and raising successfully. The other silver lining so far has been the broader acceptance of unionized labor, which I believe is a long-term gain for everyone.

For now, there are signs we may have bottomed out and are slowly moving in an upward direction.

You can download the free report here.

Some highlights from the report:

- The global market for interactive entertainment is on course to reach $250.2 billion in consumer spending in 2025E, up 4.6% year-over-year.

- Content stays king. Software publishing remains the primary revenue generator, forecasted to grow 3.6% year-over-year to $186 billion in 2024. Mobile gaming continues to dominate this category, accounting for $109.6 billion (3.6% growth), and is forecasted to reach $115.7 billion (2025E) despite market saturation and escalating user acquisition costs. Console gaming is on track to reach $44.9 billion (3.1% growth), while PC gaming shows the strongest growth at 4.2%, reaching $31.4 billion in 2024E, both with a healthier outlook for 2025.

- The second-largest segment in terms of revenue, Hardware & Accessories, presents a mixed picture. Console hardware sales are projected to decline sharply by 31% in 2024 and another -11% in 2025E, due to the end of the current console generation cycle. However, this downturn is partially offset by the resilience in the gaming PC and laptop market. Notably, accessories sales are expected to grow by 8%, indicating sustained consumer interest in peripherals and personalization.

- Emerging Technologies show promise, due to aggressive investments from large tech firms (ie. Apple, Meta) and benefitting from currency fluctuations.Virtual Reality is expected to grow 11% in 2025E, driven almost single-handedly by Mark Zuckerberg and Tim Cook. Blockchain gaming, while growing at 21% year-over-year in 2024 as a result of the appreciation in major crypto-currencies remains a niche market at $651 million. And Web-based gaming is reinvigorated, growing +5.8% to $2.9 billion in 2025E

- Esports & Live-Streaming face ongoing monetization challenges. Despite generating substantial revenues, major platforms like Twitch continue to struggle with profitability. Esports revenue is expected to decline by 3% to $173 million in 2024 and another -8% in 2025E, highlighting the difficulties in effectively monetizing competitive gaming audiences.

Major game makers show defiance. Despite acknowledging the current economic uncertainty, CEOs remain optimistic about their long-term prospects, hoping their focus on efficiency, diversification, and upcoming major releases will return growth.

Among the more notable trends on the horizon are the expanding efforts around transmedia strategies, as major entertainment companies adopt cross-platform approaches. They are looking to leverage their IP across various media to create interconnected experiences and maximize revenue potential. Microsoft, for instance, recently set up a team dedicated to building out its recently acquired IP, including Overwatch and Warcraft.

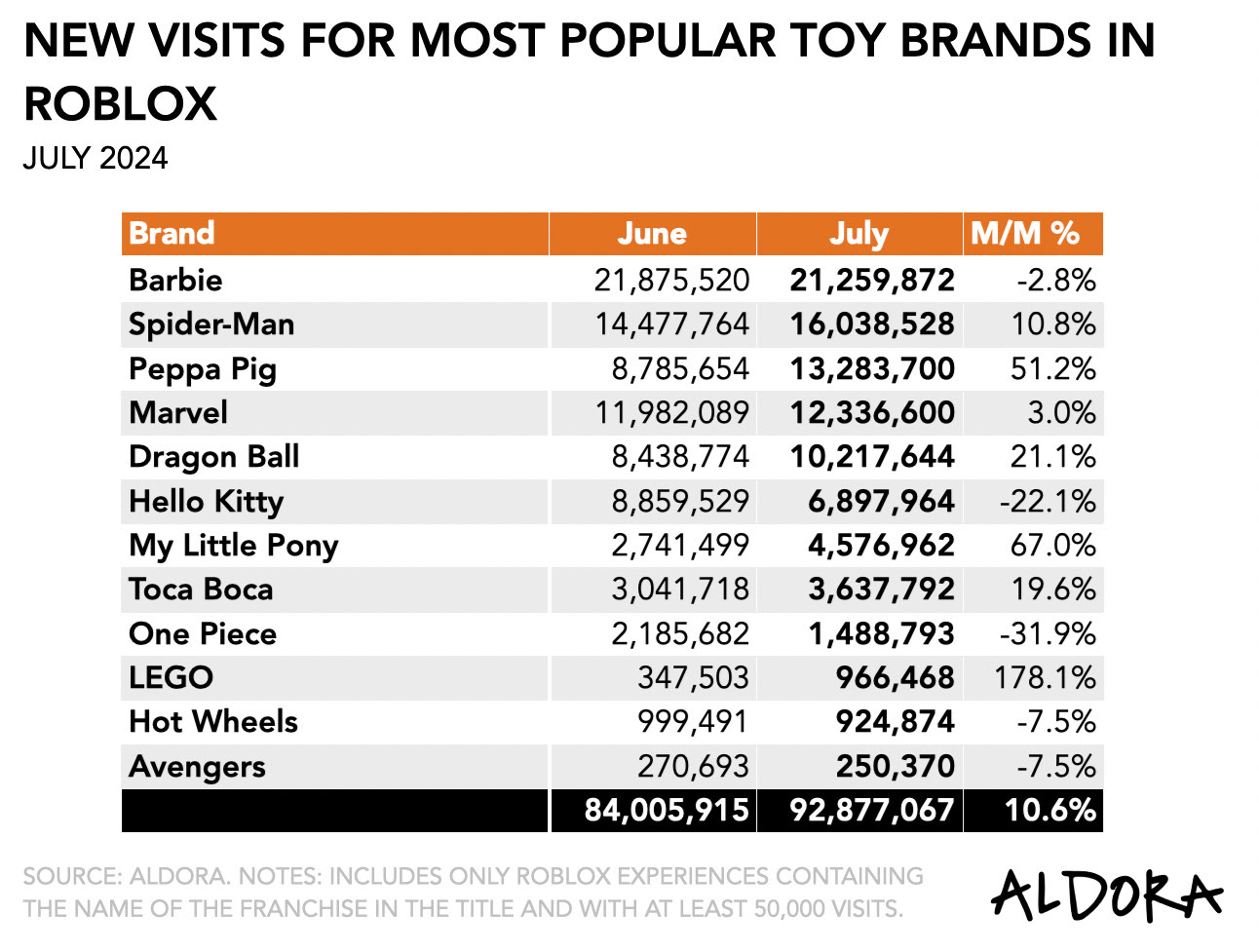

Similarly, non-endemic brands are pushing into gaming. Companies outside the traditional gaming sector, such as toymakers like Mattel and retailers like Walmart, are finding success with activations on platforms like Roblox, indicating the growing importance of interactive entertainment as a new way to build a connection with consumers.

Overall growth rates for 2024 are modest and interactive entertainment is poised for a transition period in the lead-up for next-generation experiences and devices. Companies with strong IP portfolios and diversified revenue streams across multiple segments are better positioned to weather short-term market fluctuations.

Finally, despite near-term challenges, long-term growth prospects remain strong. Companies that can successfully navigate the evolving landscape, leveraging established IP across multiple platforms and embracing new technologies, will have a better chance to emerge as winners when 2025 rolls around.