This article is written by Diana Levintova from AppMagic. Top image: four of KAYAK’s hypercasual games.

There has been a lot of talk about the future of Hypercasual games: how the market has been in stagnation, making studios slowly but steadily look for opportunities in the fraternal Hybridcasual. Leading Japanese publisher KAYAC has another opinion however.

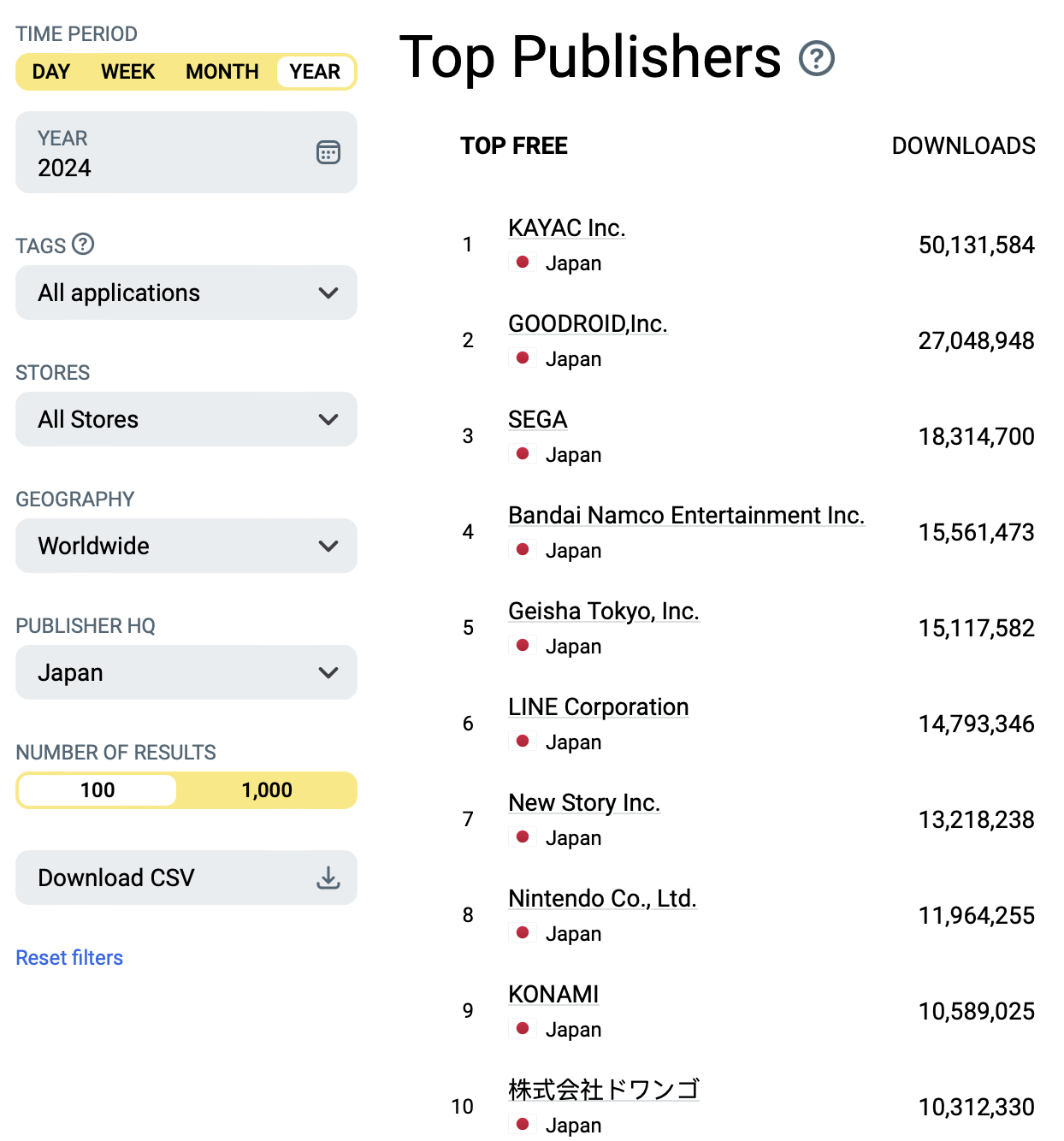

What exactly is KAYAC? Let’s take a look at their games portfolio and performance. First of all, KAYAC is the No. 1 publisher from Japan: not only in Hypercasual segment, but across the regional market in general.

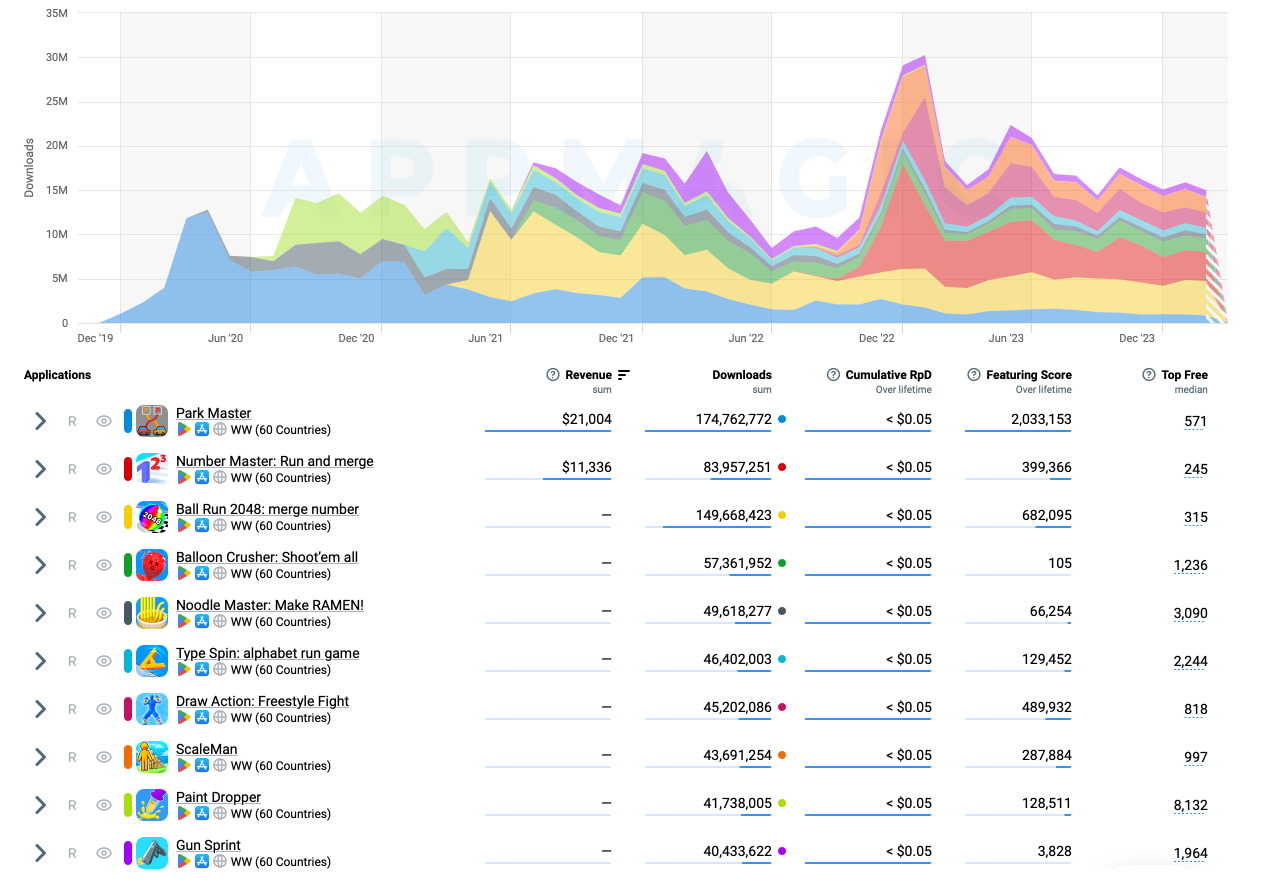

Their focus is on the Hypercasual sector, proving their deep expertise in the genre. Just this February, the KAYAC team announced that they hit the milestone of 1 billion installs. Looking at KAYAC’s games portfolio, we notice that they successfully mix two strategies: maintaining popularity of their legacy titles, such as Park Master and Ball Run 2048, as well as publishing a few new successful hits, like Ragdoll Break.

Their top 3 leading games of all time are Park Master with 175M installs, Ball Run 2048 with 149M, and the more recent Number Master with 83M.

Let’s find out how KAYAC approaches development of Hypercasual games in 2024; what their expectations from the market are; which best practices for game development they can point out; and what tips for adapting games for the Western region they have to offer.

How do you approach development of Hypercasual games in 2024, considering the general shift towards Hybridcasual?

“Last year we, indeed, noticed an active publishers’ movement towards Hybridcasual games. However, while we see Hybridcasual games as an attractive growth market, Hypercasual games are where our strength lies, with a market that remains large enough to offer significant opportunities. As such, we intend to pursue both moving forward!”

So, do you think it is still possible to launch a successful Hypercasual game in 2024?

“The short answer will be “yes, it’s still possible”. Certainly, many publishers like Voodoo, Say Games, and Homa, have shifted their focus away from the Hypercasual market. As a result, it has become difficult to discover trends in the current app store rankings. However, on the other hand, the decrease in rivals attacking the Hypercasual market also presents an opportunity.”

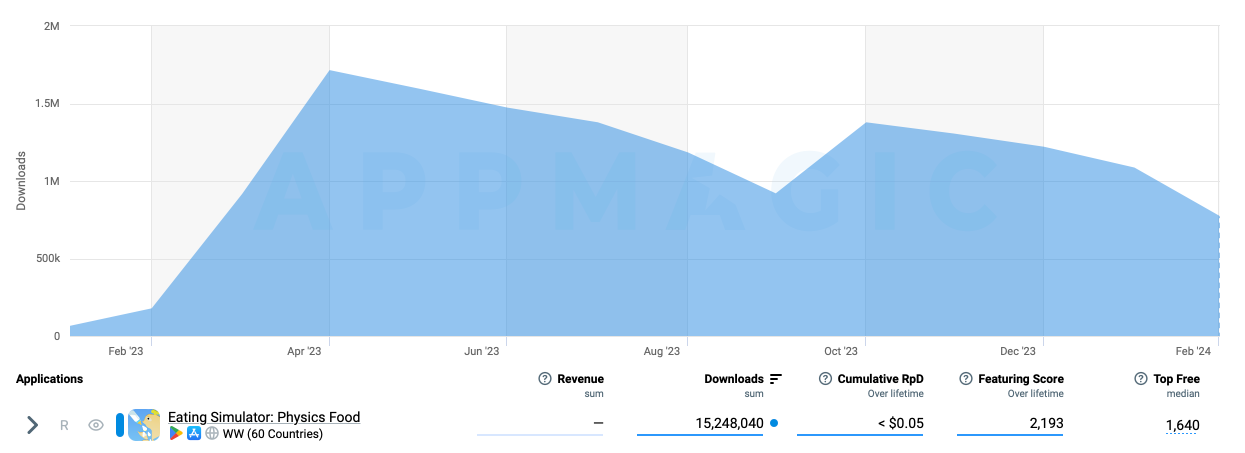

“As evident from everyone’s fixation on social media for years, content that humans instinctively find interesting continues to emerge infinitely. We can take inspiration from content going viral on platforms like TikTok and YouTube, and indeed, we have created hit games in 2023 by doing so. Our game Eating Simulator, for instance, drew inspiration from this YouTube video with 1.6M views.”

“Additionally, we believe there is potential to revive trends from a few years ago, around 2019-21. For example, games like io-style, FPS shooters, drawing mechanics games, and transform-based running games, have all passed their peak popularity, but we still see new hit titles emerging recently.”

What was the reason for the shift towards the Hybridcasual game market?

“One factor is that various subgenres of Hypercasual games, such as runners, ASMR, flip games, io games, and drawing mechanics games, have been thoroughly explored (we refer to these subgenres as “oil fields”: like oil fields, if you extract too much, they dry up). As a result, many publishers are struggling to find new game ideas.”

“However, we believe there is another major reason: the fierce competition among publishers. Developers can choose the best conditions from many publishers. As a result, price competition among publishers has intensified, making it difficult to sustain the business model. In other words, it’s not so much that the market has disappeared, but rather that the supply side can no longer maintain the supply chain.”

“Companies like KAYAC, where development and publishing teams are integrated, are less exposed to this competitive situation. We think that recently active companies like HABBY, Supercent, and LoadComplete are also in such a position. We believe that, in the labor market for game creators, companies from Japan, Korea, and China are less likely to engage in competition for developers with overseas companies, especially those in the English-speaking countries.”

“Recently, we have also come to the conclusion that major Hypercasual publishers have shifted towards the Hybridcasual side in order to avoid competition and build long-term relationships with a few developers.”

Is there a future for Hypercasual as a genre, and what does it look like?

“As mentioned earlier, the oil fields of the hyper-casual game market have been largely exhausted. However, there will never be a shortage of content that goes viral on social media platforms like TikTok and YouTube. As long as you can come up with fresh ideas, we believe it’s still possible to create a hypercasual game that scales.”

“Additionally, people tend to forget things after a few years, and past trends sometimes resurface. Thus, focusing on trends from a few years ago can also be effective. As long as smartphones are not replaced by next-generation devices like the Apple Vision Pro, the hypercasual game market will continue to exist.”

Do you have any specific regional strategy, or are you trying to fit the worldwide taste?

“Well, first of all, Hypercasual games, by nature, don’t target specific regions. Our goal is to create games that resonate with people worldwide, regardless of age or gender, with non-verbal gameplay. However, the United States stands out as the largest market, accounting for 30-40% of total revenue, so we always start prototype testing there. English serves as the default language, reflecting the market’s dominance. Consequently, Hypercasual games tend to thrive in the US and other English-speaking countries.”

“Nevertheless, we have recently noticed a significant difference in what is popular between the Asian and Western markets. Particularly in Hybridcasual games, the LTV in Japan, China, and Korea is high, increasing the importance of the Asian market. In these Asian countries, for over a decade, certain genres of games such as MMORPGs, gacha games, and IP-based games have been popular in the domestic market, with a tendency for high customer spending (LTV and ARPU). Moreover, graphic design trends loved in the West differ from those in Asia: 2D casual games tend to be favored in Asia (such as Survivor.io and Legend of Slime), whereas 3D games are more popular in the West (such as My Perfect Hotel and Mob Control). This makes it challenging to acquire users in both markets.”

Have you faced any challenges as a Japanese company trying to adapt games to the international market? Maybe you have some tips for those who are just starting?

“We believe that the size of the Japanese market can be somewhat unfortunate for Japanese companies. In the development of new businesses, Japanese companies typically conduct market tests in Japan first and then expand overseas if successful. However, this approach makes it difficult to succeed in Western or English-speaking markets. In the hypercasual game market, the United States is the largest, and since it is English-speaking, prioritizing testing there and considering Japan as secondary is crucial for success.”

“The meticulous product development style of Japanese companies can also hinder their entry into the hypercasual game market. There is a tendency to carefully plan, faithfully develop according to the plan, and prioritize internal reviews over market feedback. In the hypercasual game business, there are many companies from Southeast Asia and Eastern Europe, and we have realized that they completely differ from Japanese companies in terms of speed and flexibility. They are willing to release imperfect products with risks and receive feedback from the market to progress.”

Lastly, can you maybe share your strategy for future growth with us?

“As a major trend in the gaming industry, the Hybrid game market is expanding, and catching up with this trend is important as a business strategy. Among Hybrid games, the strategies for success vary depending on subgenres such as Match-3, Puzzle, Idle Arcade, RPG, Clicker, and .io. Trends in mobile gaming are important, but there are also approaches to consider on platforms like itch.io and Steam. Breaking down the Hybrid game business into its elements will be important.”

“However, KAYAC is originally a company with excellent ideation capabilities. Moreover, we have an integrated development-to-publishing workflow that is well-suited for the fast and flexible development required for hypercasual games. Therefore, we plan to continue producing Hypercasual games finding new inspirations and techniques for their advancement.”