This article is written by Alexandra Doroshenko from AppMagic. Top image: Merge Mansion.

2023 turned out to be no less challenging for the mobile market than the year before. User spending went down by around 3.5%, following the decline trend of 2022. Yet, the key genres were not significantly impacted, and downloads remained on the same level. Moreover, the revenue decline wasn’t even: some genres got affected more, while others succeeded in growing significantly. 2023 also saw fewer new releases compared to the year before, and there were even fewer successful ones.

With the success rate of the new games released drastically low, one can’t help but ask two questions:

- When releasing a game in 2024, which genre should I choose to make the most of it?

- How do I operate an existing project in order to maintain and increase earnings?

In this research, we explore the main trends that shaped the market last year and try to answer the questions above by finding potential opportunities for developers in 2024.

Methodology

The report mainly focuses on the performance of the mobile games market in Tier-1 West countries, which include the US, the UK, Australia, Canada, France and Germany. To operate with representative groups, we compared games across top-level subgenres. We distinguish more than 300 genres in total in our most developed genre classification in the world. Smaller casual genres were excluded, taking for consideration only those that had brought in at least $10M revenue in 2023. As a result, we processed 24 casual genres and their YoY trends.

In order to evaluate genres, we scored them by estimating their success rates. The rate was based on the comparison study of the titles’ data. We compared the total number of titles released in 2023 with the number of “successful” new titles, defined as those generating over $50K in monthly revenue in Tier-1-West countries for the last 30 days before the day when we collected our data.

You can explore all the collected data in the spreadsheet.

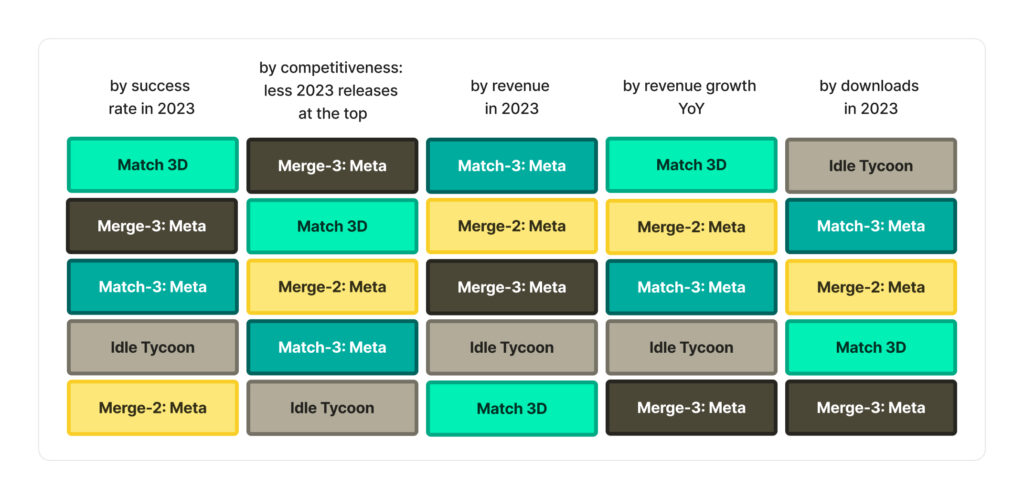

From the entire list, 5 casual genres were selected for further in-depth study:

- Merge-2 with Meta: the genre was the most promising one in 2022, and in 2023 it showed strong revenue growth.

- Match 3D: a relatively new genre with almost triple YoY revenue growth; it also had one of the highest success rates in 2023 among the casual genres explored.

- Merge-3 with Meta: the red ocean that, however, showed one of the highest success rates among the explored casual genres in 2023.

- Match-3 with Meta: the highest grossing casual genre with good revenue growth dynamics and success rate; however, highly competitive.

- Idle Tycoon: a developing genre with good potential and risk/reward ratio that seemed rather promising in 2022.

Let’s see how these casual genres fared in 2023, discovering the biggest changes and the reasons behind.

Merge-2: Meta

- 101 titles released in 2023

- 0 successful new releases (defined as those generating over $50K in monthly revenue)

In 2023, the genre grew at a more moderate pace compared to the year before, yet +73% in YoY revenue is still a significant result for the market. All of the revenue gains were achieved thanks to the growth of older titles, while there were no successful releases in Tier-1 West. However, My Hamster Story took off in the Asian market.

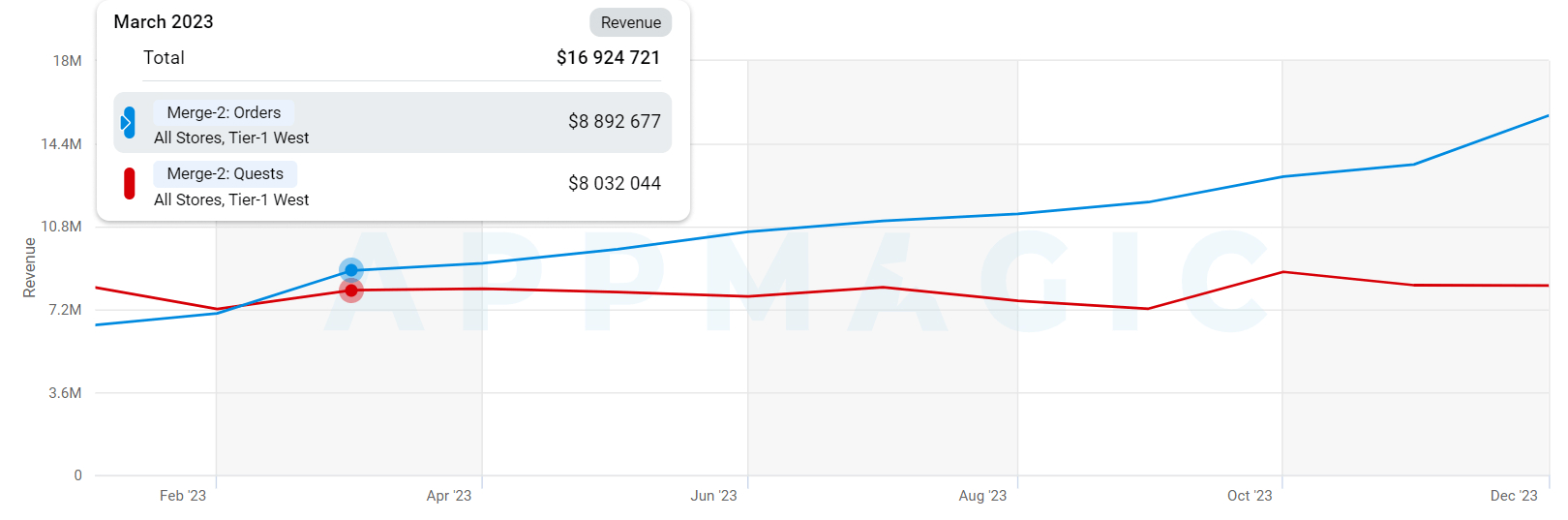

We distinguish two main subgenres of “Merge-2 with Meta” in our classification: games with quests (“Merge Mansion-likes”) and games with orders (“Love & Pies-likes”). In games with a quest system, players progress in the meta directly by completing merge requests on the board, while in “Merge-2 with Orders” players obtain soft currency for completing orders and then spend it to progress in the metagame. At the start of the year, games with orders overtook ones with quests in monthly revenue and continued to grow rapidly. “Merge-2 with Orders” also did well in downloads: players installed them 4 times more often.

Monthly revenue for “Merge-2” in Tier-1 West countries in Jan-Dec 2023

Monthly revenue for “Merge-2” in Tier-1 West countries in Jan-Dec 2023

It is worth pointing out that there were only 2 new games with quests released, which indicates that developers have lost faith in success in this niche monopolized by Merge Mansion. Things aren’t looking up for this title either, as it fell by 25% in downloads compared to the year before. However, Merge Mansion is still gaining in revenue by monetizing its existing user base.

Another top-grossing game with quests, Merge Manor: Sunny House, didn’t manage to compete with the Merge Mansion. The game was only able to scrape 3% of the leader’s revenue. After large traffic acquisition in summer, earnings continue to slip down. The dynamics of Sunny House’s RpD show that the game retains users worse than Merge Mansion. Such lower retention is a result of a weaker LiveOps system and marketing that were unable to compete with Merge Mansion. Thus, the risk/reward ratio in the “Merge-2 with Quests” subgenre is now heavily biased towards risks.

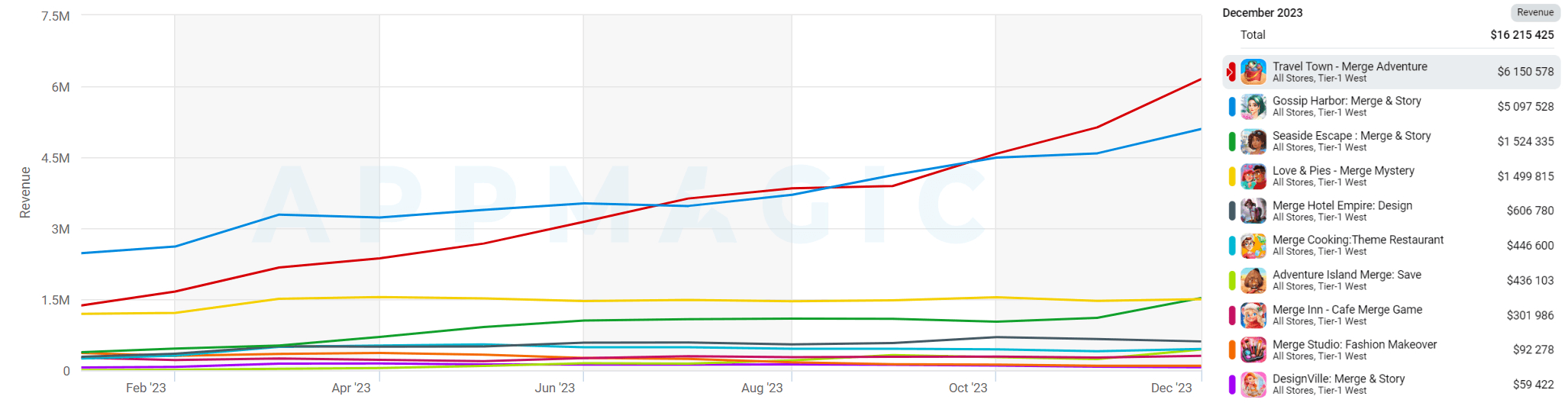

For “Merge-2 with Orders”, the year was more eventful. Travel Town—one of the subgenre’s founders—displaced Gossip Harbor and reclaimed its position as the revenue leader again after a year’s break. Although two games have significant differences in core mechanics, we found out, as a part of our Travel Town deconstruction, that the main reason for its take-off is a unique approach to LiveOps and monetization.

Magmatic Games, the developer of Travel Town, managed to reverse the trend and regain leadership, outpacing the competitor in revenue significantly, thanks to very effective and non-obvious solutions that we thoroughly studied in our in-depth research of Travel Town. Contact us to receive the full Travel Town’s deconstruction.

Revenue for the top grossing “Merge-2 with Orders” titles in Tier-1 West countries in Jan-Dec 2023

Revenue for the top grossing “Merge-2 with Orders” titles in Tier-1 West countries in Jan-Dec 2023

Another founder of the subgenre—Love & Pies—dropped to the 4th place as ranked by revenue. According to our study, the game is characterized by a rather weaker LiveOps than its competitors, featuring fewer unique events in the constant rotation while new events with interesting mechanics appear rarely. The weekend events in the game also certainly have room for improvement.

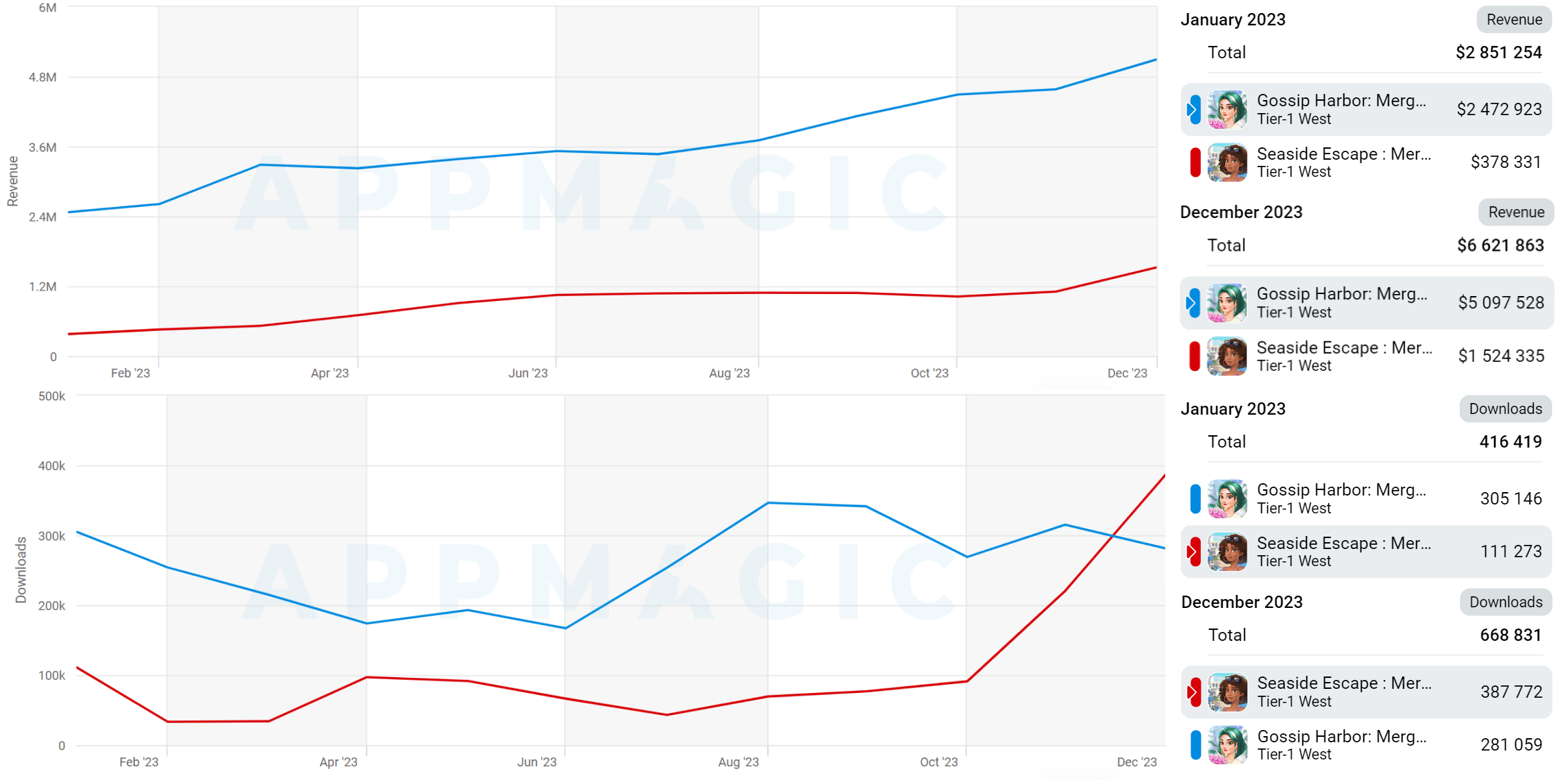

Gossip Harbor and Seaside Escape, the two brainchildren of Microfun Limited, which replicated other successful titles (Love & Pies and Travel Town respectively), continued to gain revenue and downloads this year. The titles provided a real example of how a strategy of “replicating and polishing” may work out.

Revenue and downloads forGossip HarborandSeaside Escapein Tier-1 West countries in Jan-Dec 2023

Revenue and downloads forGossip HarborandSeaside Escapein Tier-1 West countries in Jan-Dec 2023

One title distinguished itself among other “Merge-2” games with a misleading approach used in its app store page and creatives that can potentially reduce traffic costs. It was the Adventure Island Merge: Save by KINGS FORTUNE. Coupled with the frequent rotation of creatives and ASO, the approach supposedly worked, since the game came in 3rd by downloads in December and keeps constantly gaining in revenue. Adventure Island Merge is an example of a title where marketing strategy contributed the most to its success.

Despite no successful releases in 2023, the top 10 grossing games with orders changed significantly over the year, introducing 3 new titles released in 2022. It is possible that, on average, a “Merge-2” game needs more than a year from its initial release to reach its full potential: most of the successful games in the genre indeed grew rather slowly. This leads us to assume that the case of Gossip Harbor and Seaside Escape, partly explained by the publisher’s previous expertise in the genre, is more of an exception from the general rule.

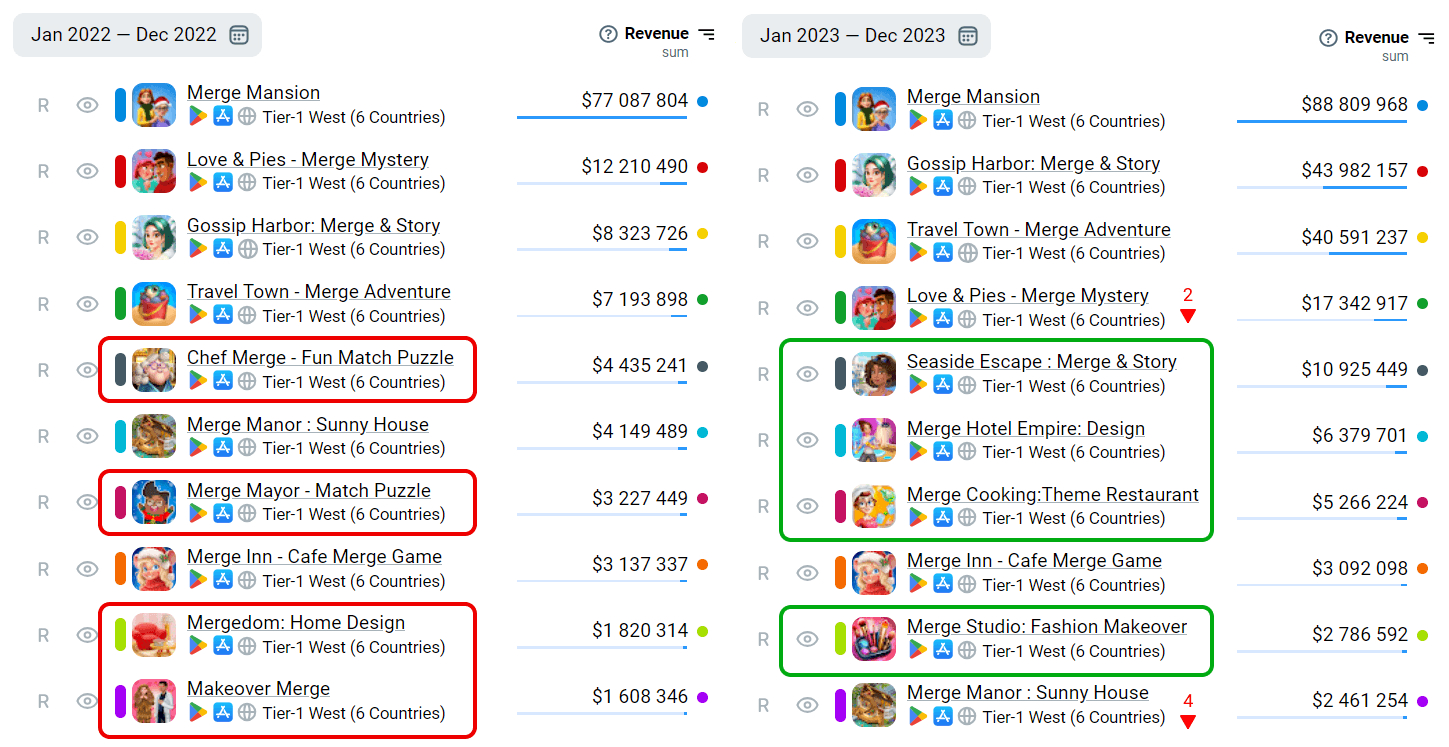

Top grossing charts for “Merge-2 with Meta” in 2022 and 2023, Tier-1 West countries. Titles that left the top in 2023 compared to 2022 are highlighted in red; titles that joined the top in 2023—in green.

Top grossing charts for “Merge-2 with Meta” in 2022 and 2023, Tier-1 West countries. Titles that left the top in 2023 compared to 2022 are highlighted in red; titles that joined the top in 2023—in green.

Match 3D

- 65 titles released in 2023

- 5 successful new releases

- 8% success rate

In the 2022 report, we wrote about the interesting dynamics of the “Match-3: Tile” genre. And in 2023, a related genre, “Match 3D”, gave an amazing performance. Games of these two genres are similar core-wise: players complete levels by searching and matching identical objects. However, “Match 3D” games have two main distinctions:

- Objects for matching in “Match 3D” act like physical ones: they can be moved, tossed and turned. It adds randomness to each attempt to complete the level.

- Time-limited levels create time pressure that is unusual for meditative puzzle games. Specific “Match 3D” mechanics make it problematic to add any other twists to the gameplay, since ,if players have enough time, they can complete any level. Time-limited levels contribute to the game’s monetization, as players can be offered various paid options to bypass the time limits.

Simple core and graphics of the “Match 3D” genre slightly resemble hypercasual games. It allows promoting new titles with hypercasual creatives and lower traffic costs.

“Match 3D” stands out with its relatively high success rate. Furthermore, the dynamics of the genre`s revenue growth are similar to the fast-growing “Merge-2 with Meta”. However, the difference lies in the revenue growth structure of the two genres: in “Merge-2 with Meta”, only older titles contributed to the revenue growth in 2023, while in the “Match 3D”, the more recent releases pushed the niche forward.

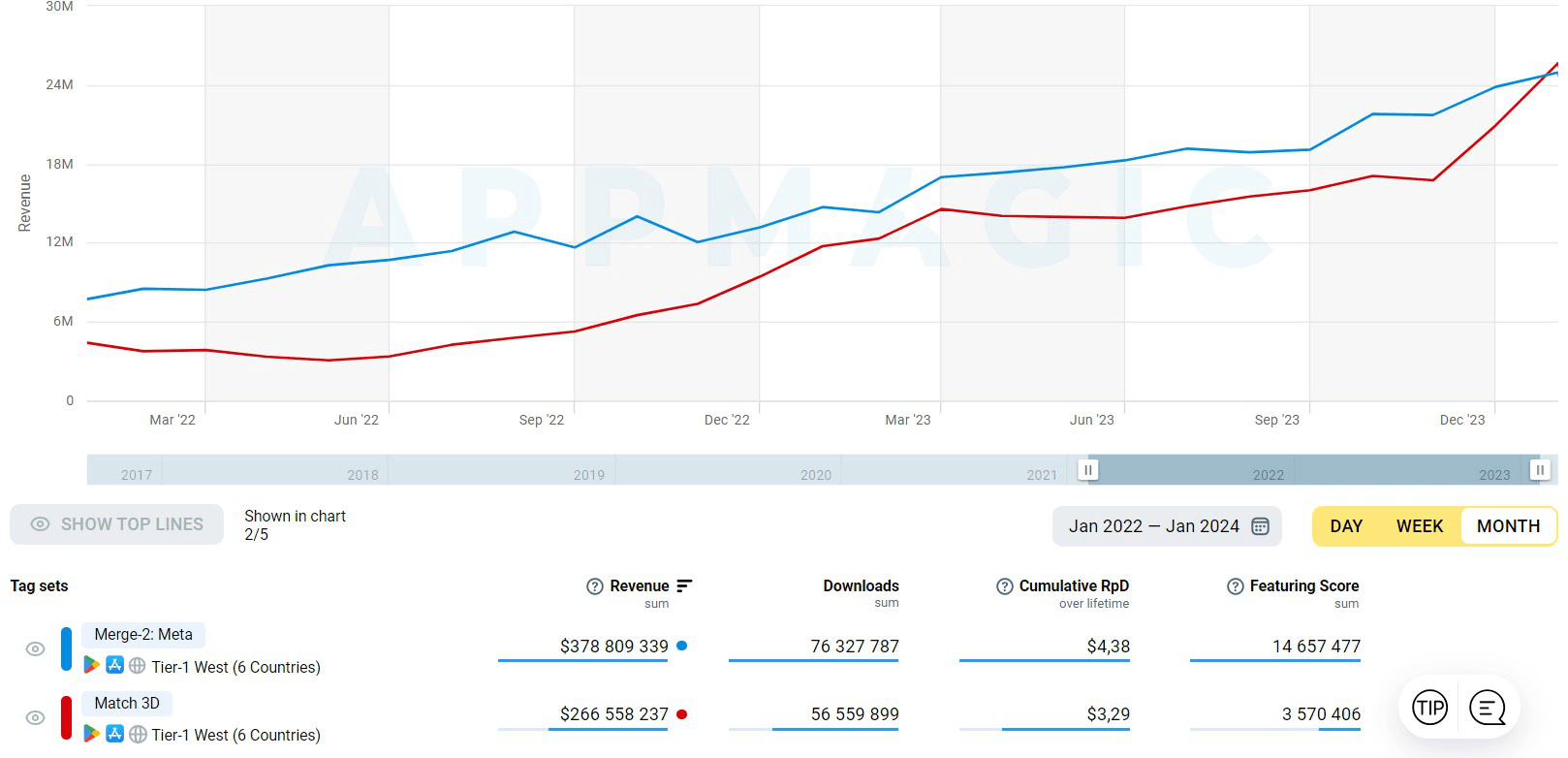

Revenue dynamics comparison for “Match 3D” and “Merge-2 with Meta”

Revenue dynamics comparison for “Match 3D” and “Merge-2 with Meta”

The high success rate of the genre is achieved thanks to the large numbers of successful newcomers, while there are fewer new titles overall compared to other genres. There are as many as 4 games in the genre that earned more than $1M in December 2023, with one of them, Triple Match 3D, even reaching the $10M mark.

The highest grossing newbie is Match Factory! by Peak Games, the publisher of Toon Blast. The game even entered the top highest-earning ranks released in 2023. Match Factory!’s meta features social mechanics: clans and leaderboards and goal-setting that help increase long-term retention while the core in the game remains quite hypercasual.

Happy Match Cafe, another successful newcomer, saw revenue growth in the middle of the year. The game stands out in the genre with its renovation and customization meta similar to the ones that top grossing “Merge-2” games have. Another similarity is that the narrative has elements of mystery. The game, as many other titles, uses misleading elements in their marketing strategy, built around simple “one-line drawing” mechanics. The publisher KINGS FORTUNE is also known for its misleading approach to promoting Adventure Island Merge: Save.

New titles of the genre managed to snatch their share of the market while there was a big player present: Triple Match 3D; however, the niche has been thriving for two years now, and it is possible that the window of opportunity may close here soon. Developing more complex meta, such as renovation or makeover, may be the way to help the next generation of “Match 3D” evolve.

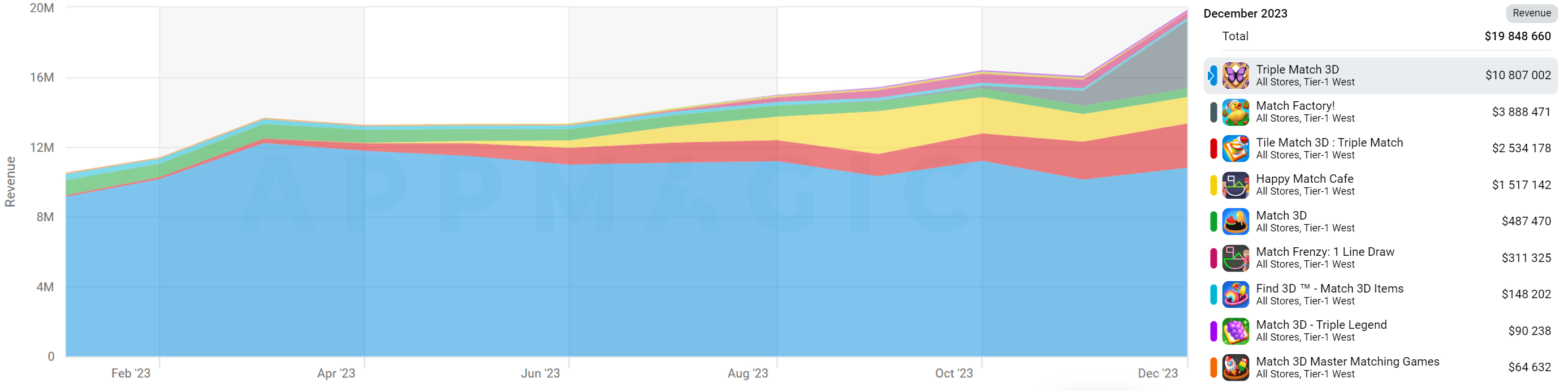

Revenue for the top grossing “Match 3D” titles in Tier-1 West in Jan-Dec 2023

Revenue for the top grossing “Match 3D” titles in Tier-1 West in Jan-Dec 2023

Idle Tycoon

- 412 titles released in 2023

- 3 successful new titles

- 0.7% success rate

Downloads of “Idle Tycoons”, despite the downward trend throughout the year, increased by almost 13% compared to 2022. Yet the genre hardly grew in terms of user spending. A new title, Isekai: Slow Life contributed the most, bringing in 25% of the genre’s revenue in December. Isekai:Slow Life managed to competently export the Asian approach to monetization to Tier-1 West and become, in less than half a year, the highest grossing “Idle Tycoon” in terms of monthly revenue.

As we found out during our research into Asian Tycoons, the meta of the game includes many “layers” of mechanics with their own special currencies, all intertwined in gameplay and the economicals. It strongly contributes to the session length and creates huge amounts of monetization touch-points that increase the IAP potential of the title significantly.

Contact us to receive our Asian “Idle Tycoons” research featuring Isekai: Slow Life!

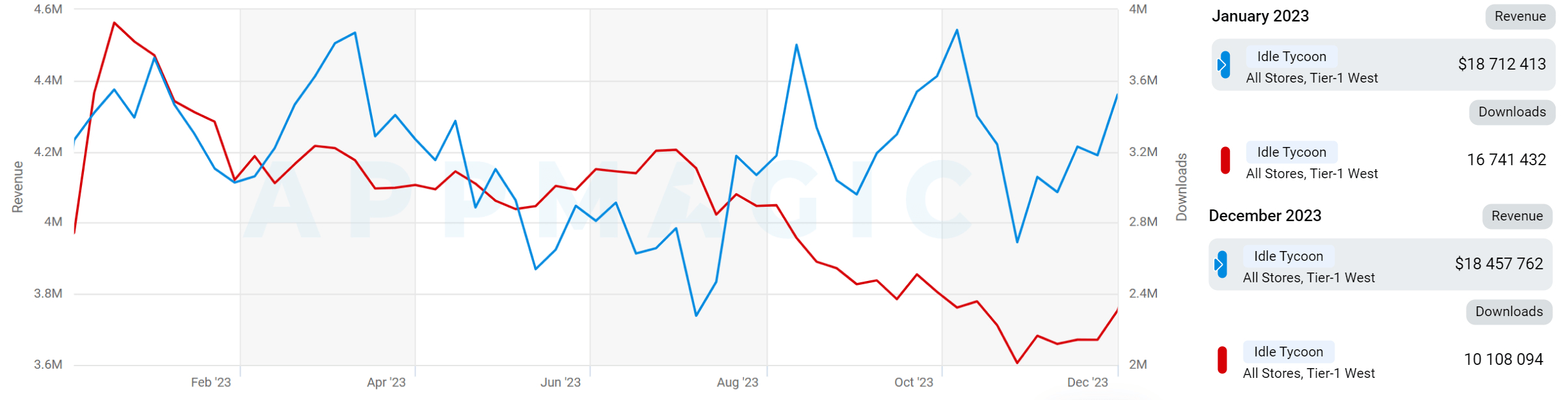

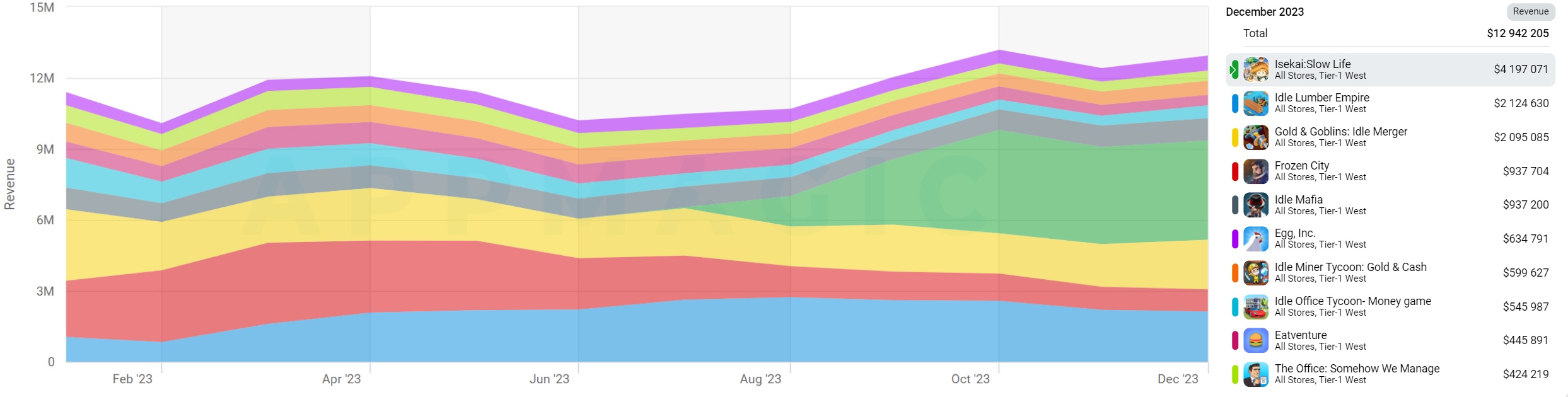

Revenue and downloads for “Idle Tycoons” in Tier-1 West in Jan-Dec 2023

Revenue and downloads for “Idle Tycoons” in Tier-1 West in Jan-Dec 2023

Revenue for the top grossing “Idle Tycoons” in Tier-1 West in Jan-Dec 2023

Revenue for the top grossing “Idle Tycoons” in Tier-1 West in Jan-Dec 2023

Two other successful newbies replicated older successful games: Idle Basketball Arena Tycoon inspired by Idle Office Tycoon and Goblins Wood: Tycoon Idle Game, a clone of Gold & Goblins.

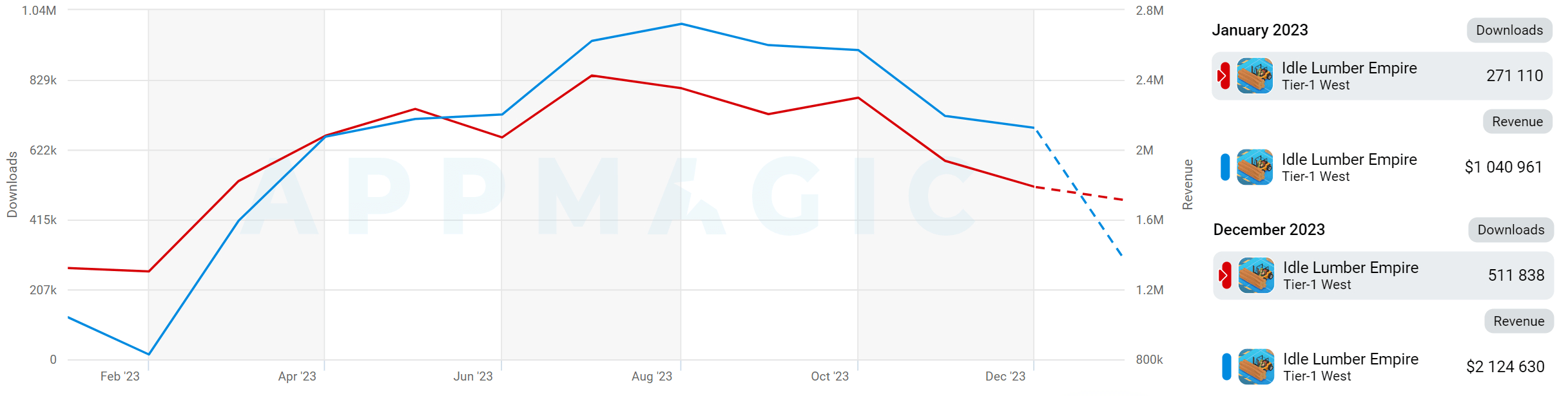

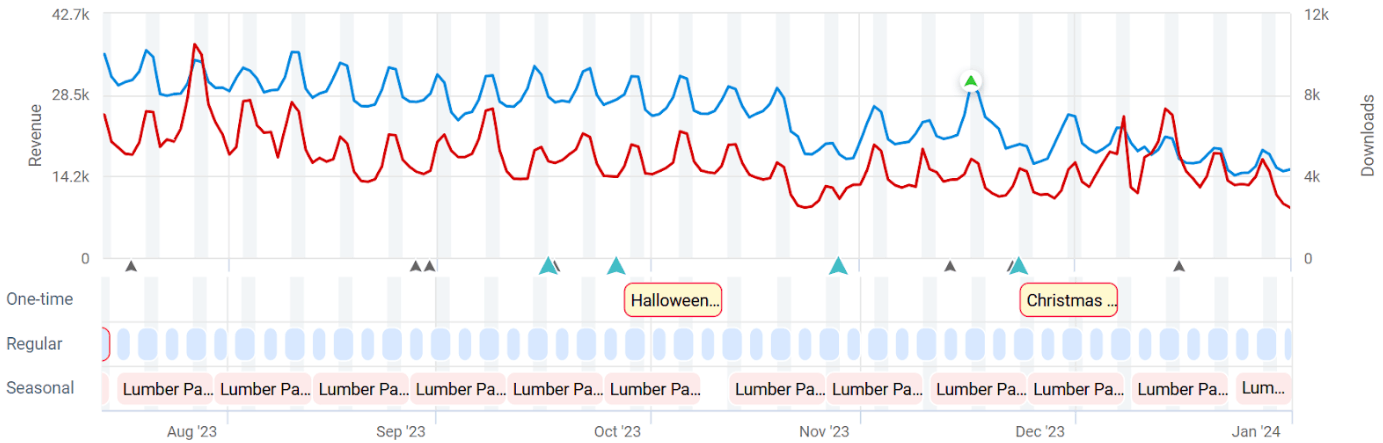

Talking about the tops of the genre, Idle Lumber Empire had been growing in revenue and downloads since the beginning of the year. The title almost managed to repeat its highest historical metrics of January 2021. In our LiveOps & Updates Calendar, we recorded numerous new mechanics, types of events and monetization offers that were added to Idle Lumber Empire throughout 2023. The experiments with LiveOps and monetization certainly contributed to the game’s metrics growth.

Revenue and downloads forIdle Lumber Empirein Tier-1 West in Jan-Dec 2023

Revenue and downloads forIdle Lumber Empirein Tier-1 West in Jan-Dec 2023

Contact us to receive a demo of the LiveOps & Updates Calendar that includes all the events of Idle Lumber Empire

Contact us to receive a demo of the LiveOps & Updates Calendar that includes all the events of Idle Lumber Empire

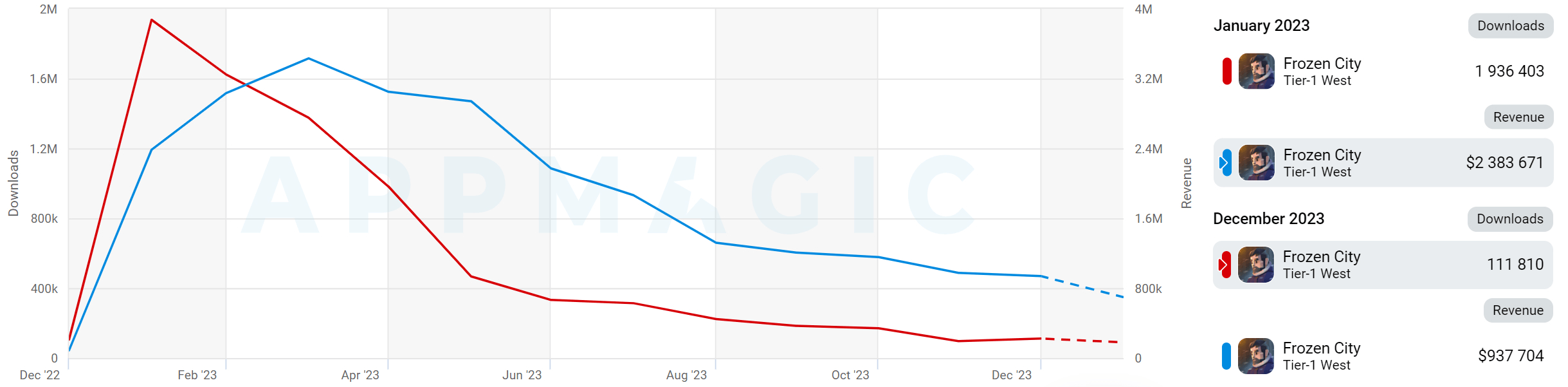

Frozen City, which stood out in the genre due to its unusual winterpunk setting, achieved its record-breaking revenue in January 2023 and the highest number of downloads in March. From then onwards and until the end of the year, metrics decreased symmetrically; that may indicate weak long-term player monetization. In our Frozen City deconstruction, we found out that the main reasons for that were the lack of a strong meta and social mechanics, as well as a small variety of unique events in LiveOps rotation in the past. However, the game is constantly experimenting with adding new mechanics and events, so we may see some improvements in its metrics in the future.

Revenue and downloads for Frozen City in Tier-1 West in Jan-Dec 2023

Revenue and downloads for Frozen City in Tier-1 West in Jan-Dec 2023

In conclusion, the “Idle Tycoon” genre is highly competitive, and developers need to constantly improve the game itself, as well as the LiveOps and monetization systems, to grab players’ attention, engage and monetize them for as long as possible.

We also recommend taking a closer look at Asian “Idle Tycoons”, such as Isekai: Slow Life, as we discovered noteworthy gameplay, LiveOps and monetization strategies within those titles. Contact us to learn more about our research.

Match-3: Meta

- 162 titles released in 2023

- 4 successful new releases (and 6 worldwide)

- 2.5% success rate

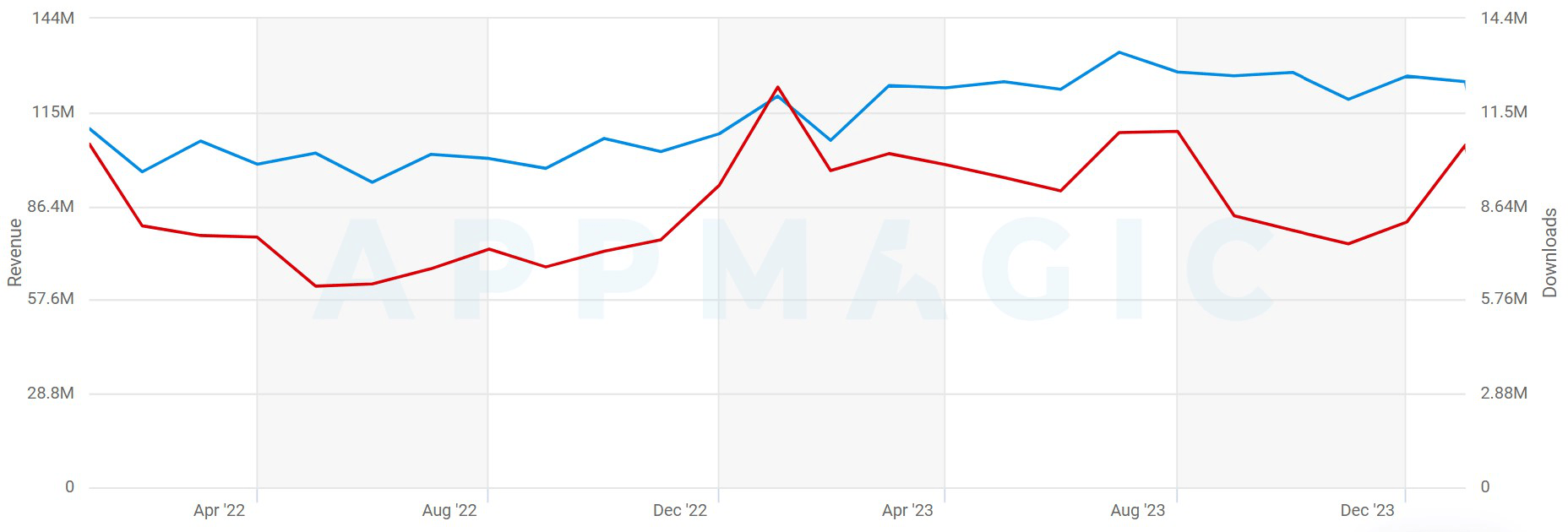

Despite the overall market decline in 2023, the “Match-3 with Meta” (a.k.a. simply “Match-3” excluding games with no developed metagame) grew significantly in YoY revenue. However, it was fuelled majorly by the older titles: Royal Match and Gardenscapes.

Downloads saw a decline trend throughout 2023 yet grew overall on the previous year. A new 2023 release, Chrome Valley Customs, influenced this as well as other older titles.

Revenue and downloads for “Match-3 with Meta” in Tier-1 West in Jan 2022–Jan 2024

Revenue and downloads for “Match-3 with Meta” in Tier-1 West in Jan 2022–Jan 2024

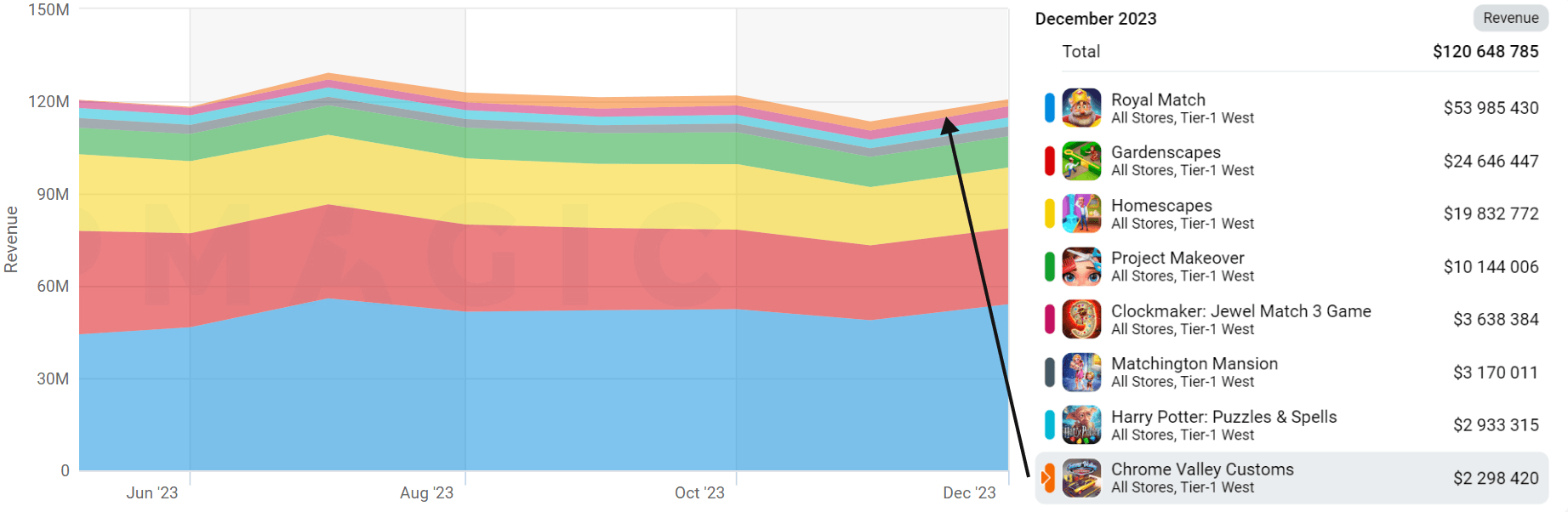

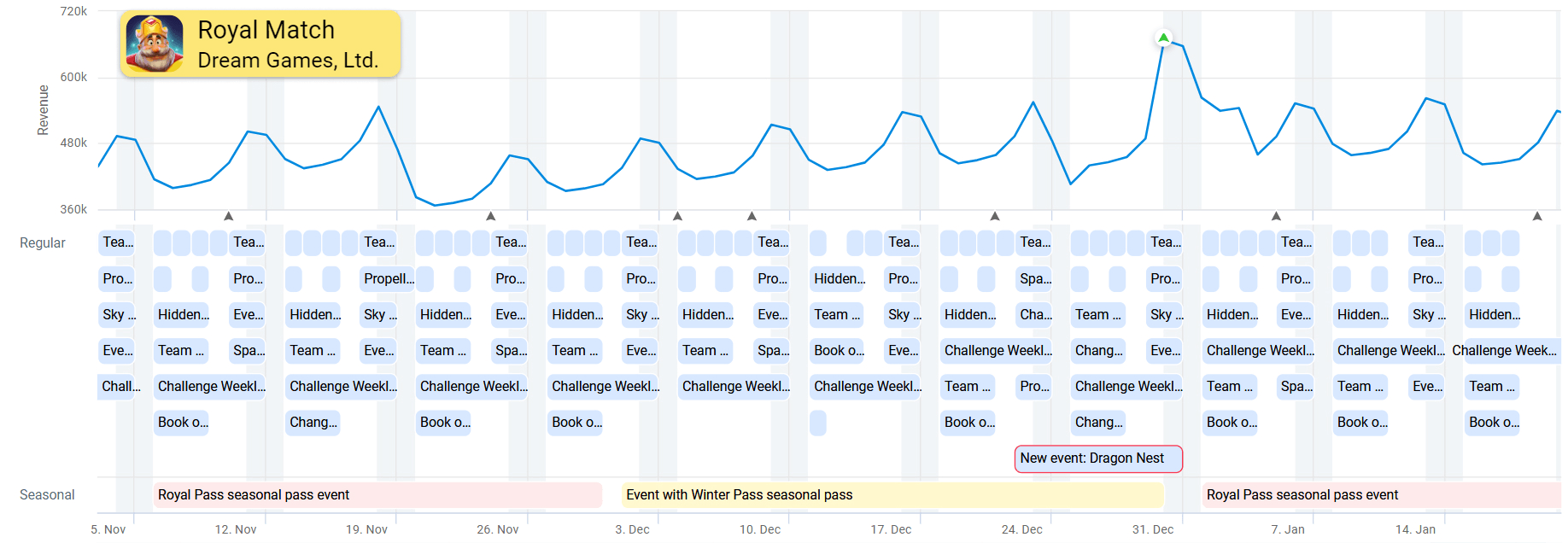

Royal Match, the highest grossing “Match-3” title, hit the $1B mark in 2023. At the same time, its publisher Dream Games soft-launched another “Match-3” game, Royal Kingdom, which already reached $1M revenue in December 2023.

One special newcomer—Chrome Valley Customs by Space Ape—successfully broke into the top of the highest-earning “Match-3” titles of the year. By introducing a non-typical Real Life setting, the game managed to compete with the top “Match-3” games and occupy its niche. Chrome Valley Customs is clearly targeting the male audience, which makes it outstanding in the “Match-3” genre that tends to target the female audience.

Among the newcomers, one more title, the Forza Customs – Restore Cars by Hutch Games, had the similar setting. Thus, introducing an unusual setting is a possible yet risky way for a newcomer to stand out and gain momentum even when it seems that all the earnings in the niche have already been distributed.

Revenue for the top grossing “Match-3 with Meta” games in Tier-1 West in Jan-Dec 2023

Revenue for the top grossing “Match-3 with Meta” games in Tier-1 West in Jan-Dec 2023

Merge-3: Meta

- 41 titles released in 2023

- 3 successful new releases

- 7.3% success rate

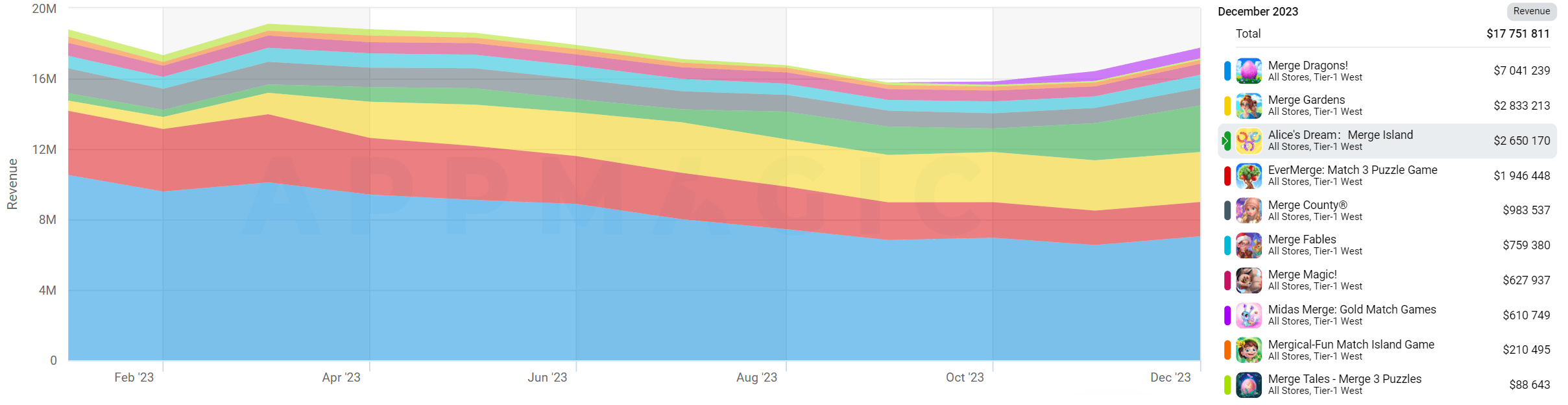

Recently, the “Merge-3 with Meta” genre has been associated with high costs and complexity of production along with a “no-promises-here” outcome: a real trap for newcomers. The list of market leaders has hardly changed for years. Nevertheless, we still have valuable insights here!

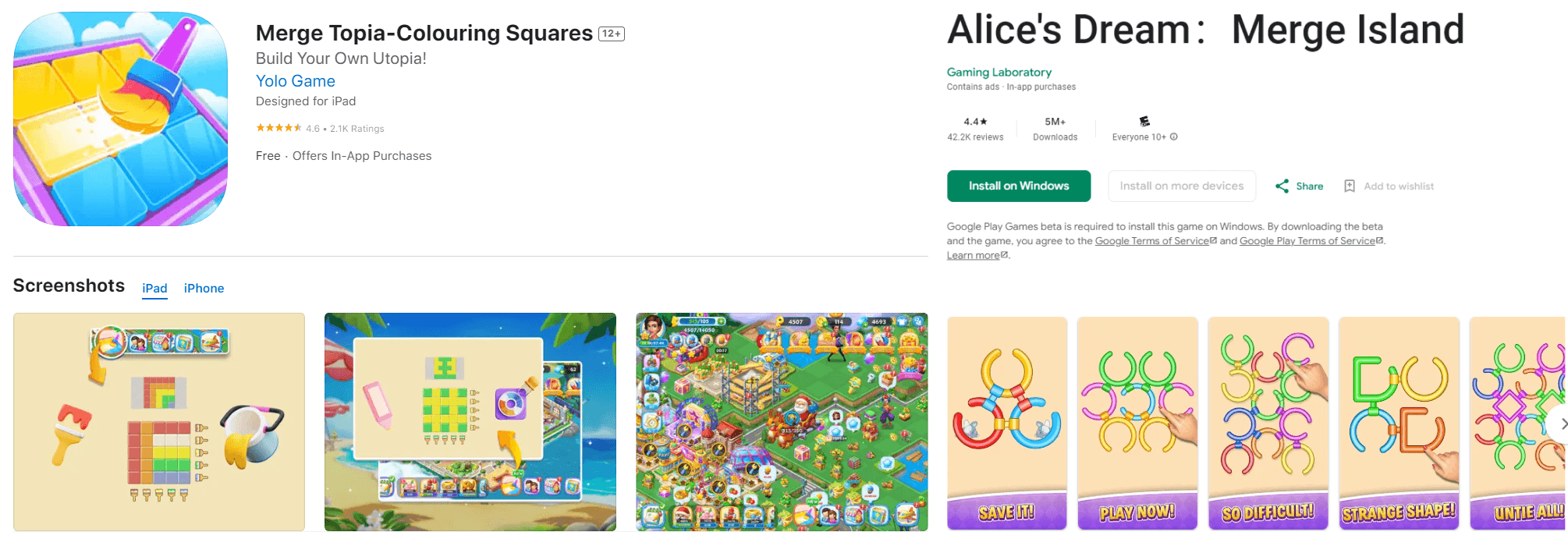

Alice’s Dream: Merge Island, an “EverMerge-like” game released in 2022 by anonymous developers, overtook the actual EverMerge by revenue in December 2023. Alice’s Dream: Merge Island stands out with its aggressive marketing. The game, as many others, also uses the hypercasual misleading approach to ASO and creatives.

Revenue for the “Merge-3 with Meta” top grossing games in Tier-1 West in Jan-Dec 2023

Revenue for the “Merge-3 with Meta” top grossing games in Tier-1 West in Jan-Dec 2023

In 2023, the genre featured a relatively small number of new releases; however, 3 of them managed to become successful.

A successful newbie by Yolo Games – Merge Topia-Colouring Squares features misleading elements in ASO and creatives. The publisher uses the same strategy to reduce traffic costs as we have already seen in this research.

Examples of the misleading approach in ASO

Examples of the misleading approach in ASO

It is worth noting that almost all of the new games of 2023, including successful ones, do not replicate the highest grossing “Merge-3” titles: the notorious EverMerge and Merge Dragons. Perhaps, the era of “Merge-3” clone wars is coming to an end, and we will see more experimental titles in this niche.

Key Takeaways

Let’s sum up by returning to the two main questions from the Intro:

- When releasing a game in 2024, which genre should I choose to make the most of it?

- How do I operate an existing project in order to maintain and increase earnings?

Merge-2 with Orders

- The niche continues to grow, and fierce competition for new users is present. It is illustrated by the genre’s top grossing ranking, which has changed expressly over the year. Considering a significant number of competitors, the success in the genre will most likely come no sooner than a year after the release. Therefore, we infer that the genre has higher risks, yet the possible reward is substantial.

- To keep up the earnings in a strongly competitive genre, you need to constantly monitor the updates and ongoing in-game events of the competitors. To optimize this process, developers may use the LiveOps & Updates Calendar by AppMagic, where we already collect the most important data about “Merge-2” games.

Match 3D

- The genre stands out with its high success rate and strong revenue growth dynamics. The genre is still not so saturated: a significant number of new releases got their share of the market and even entered the top grossing ranks. Considering all this, “Match 3D” may present potential opportunities in 2024. Developing more complex meta, such as renovation or makeover, may be the way to help the next generation of “Match 3D” to evolve. More insights on how to build such meta can be gleaned from our deconstructions, which delve deep into the most successful casual games.

- We consider that the existing top titles in the genre haven’t yet unleashed their full potential in terms of revenue. Introducing more complex and diverse mechanics, as a potential point of growth, may contribute to player engagement and long-term retention, unlocking new ways of monetization.

Idle Tycoon

- The genre still has a good risk/reward ratio—not the biggest reward, however. The strategy of replicating and improving the top grossing games may work, as evidenced by two successful newcomers.

- A significant revenue share of the games in the genre comes from various LiveOps monetization tools. So, it is extremely important to constantly improve the LiveOps itself and the monetization in the game. Based on our research, Asian “Idle Tycoons” often feature noteworthy solutions that may later be referenced by successful West-targeted titles.

Match-3 with Meta

- Revenue in the genre is still distributed among several highest grossing titles, yet the newcomer can still stand out in this competitive niche by introducing an unusual setting that differentiates the game’s target audience from the typical audience of the genre. However, such an approach may be quite risky.

- You can find out more about upgrading an existing game in our LiveOps & Updates Calendar, where we collect all the important data on the top grossing games. Connect with us to book a demo!

Merge-3 with Meta

- For the newbies, the genre still looks like a red ocean with high production costs and uncertain outcomes. Yet, most of the new “Merge-3” games do not replicate the two highest grossing titles of the genre. Perhaps, it is time for more experiments in the niche.

- For the games already released, developers test various misleading approaches in marketing that may help increase the ROI by reducing traffic acquisition cost.

For your convenience, we have compiled a table of genre distribution according to the criteria we’ve analyzed. You can use it to decide in which genre to make a game in 2024!