District Court Judge Corley ruled in favor of Microsoft and denied the Federal Trade Commission’s (FTC) request for a temporary injunction that would block the acquisition. With the ruling, Microsoft is one important step closer to getting the deal done. In response, both the FTC and its UK counterpart, the Competition and Markets Authority (CMA), have indicated they are ready to throw the kitchen sink at this deal.

In her statement, Judge Corley ruled that the antitrust watchdog had not convincingly demonstrated that the merger would result in a substantial lessening of competition. While Microsoft would have the ability to make Call of Duty exclusive to its platforms, Corley stated it would not have the incentive to do so as this would limit its user base, potentially cause reputational harm, and not make financial sense.

Judicial Error

Unperturbed, the FTC filed an appeal with the Circuit Court in response to overturn the District Court’s decision. However, it would need to show a judicial error. Having read through Corley’s statement, it is highly unlikely the watchdog will manage to do so. Her three-page skewering of the FTC’s expert witness, Professor Robin Lee, was thorough and indicative of a judge that understands the subject matter of this case well. A judicial error is also not the same as the FTC suddenly having a really strong case, which it doesn’t.

Over in the UK, the CMA is flexing, too. If you recall, part of what incentivized the FTC to ask for an injunction was the possibility of Microsoft finding a path to close the deal in the UK. Immediately following the ruling, the CMA confirmed that it is “ready to consider any proposals from Microsoft to restructure the transaction in a way that would address the concerns.” But after initially seeming agreeable, however, the watchdog followed up with a statement to The Verge noting a restructuring of the deal could warrant a new investigation. We’ll see.

Weak Foundation

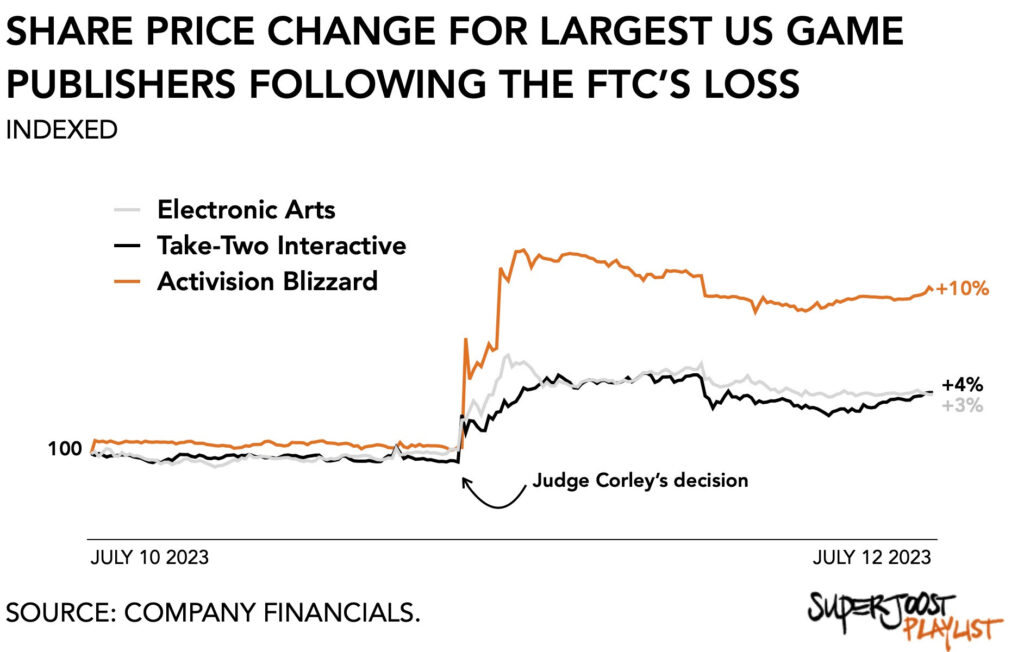

Both regulators are in a weaker position now than they were at the start. Having shown the data and weak foundation on which both the FTC and CMA argue that the deal is to the detriment of consumers, additional legislation and prolonging the proceedings seems increasingly moot. Inversely it means the likelihood of this deal closing has increased. At least, that seems to be the sentiment on Wall Street.

Following the news, both the share prices for Take-Two Interactive and Electronic Arts shot up as well. Certainly, the legal turmoil around the ABK/MSFT deal has discouraged a lot of acquisitive firms in gaming, tech, and entertainment for fear of being blocked, too. A fear that now seems to subside. In the case of EA that makes sense. In May last year, I was told EA had ‘hired bankers‘ and the recent separation into two divisions—EA Entertainment and EA SPORTS—reeks of primping, especially in the lead-up to the release of EA SPORTS FC, which is going to have to replace the FIFA franchise.

Acquisition Target

Take-Two is also an acquisition target. But with the release of Grand Theft Auto 6 finally on the schedule and the success of the Zynga acquisition, who’s going to spend that kind of cheddar? My guess is Zelnick is going to need to see a number well beyond $200 billion to interrupt his workout routine.

A large platform hoping to build out its games division may be an obvious acquirer, but I’m not so sure. Amazon can’t be bothered to acquire Ubisoft or Embracer, so EA and Take-Two are even less likely candidates. And can you imagine the fallout of Chinese juggernaut Tencent offering to buy one of the largest American game makers? I don’t think so.

And speaking of money, since the ABK/MSFT saga isn’t quite over yet, Bobby Kotick would stand to gain from pushing the deal date further out in exchange for a premium. He has the leverage to ask for a higher price for Microsoft to avoid the $2.7 billion termination fee. Some estimates I’ve heard would put the share price 10 percent higher, at $107. But I’m not convinced that it is money that motivated Kotick at this point. He doesn’t want to be richer. He wants to be right. At least, judging by the comments he’s made throughout the past year (e.g., the UK is ‘closed for business‘), and Kotick is most likely to cool out and wait for his check to show up.

Final Order

So what of this “small divestiture” in the UK? I expect the CMA to issue a significant rewrite of its so-called Final Order.” Two weeks ago it indicated that it was overwhelmed and that “a great deal of time is being spent by the CMA preparing for the final order consequent on the Decision”. It suggests to me that there’s a good chance the CMA is going to allow the deal to go forward globally before the July 18 deadline, and negotiate a minor structural remedy by, for instance, maintaining a divested corporate structure in the UK. In February I suggested that spinning off Blizzard would perhaps be a satisfactory solution, although Microsoft never confirmed this. Another option is to manage the UK market under a separate entity or formulate a localized version of Game Pass exclusively for the UK that does not offer any of the Activision titles.

As we approach the end of what is a landmark acquisition case, the most value created comes in the form of a massive teachable moment. I struggle to imagine another industry where such dealings are as closely monitored by literally everyone in the food chain. Was there a play-by-play on social media among cellphone subscribers when AT&T made its case to acquire WarnerMedia? Did any readers rebel rouse during the proceedings around Penguin Random House’s attempt to buy Simon & Schuster? I don’t think so.

Regulators and lawyers learned all about the games industry. And gamers learned about antitrust regulation and its proceedings.

That’s a win.