Top image by Freepik.

In the wake of 2023, a year marked by blockbuster game releases, the global PC and console gaming market is facing a period of moderation. While the industry still exhibits growth, the trajectory is more subdued compared to the rapid expansion seen in previous years.

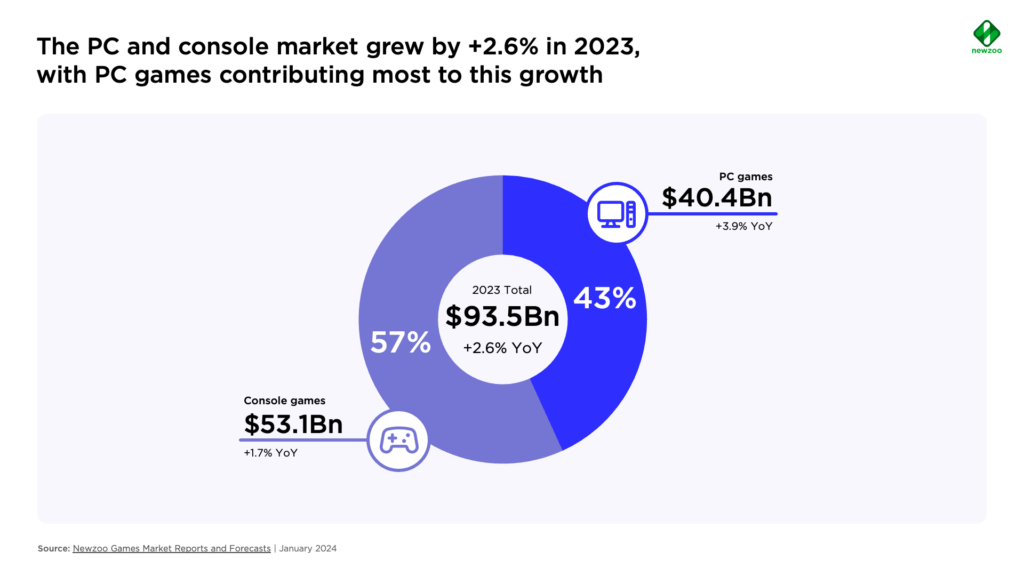

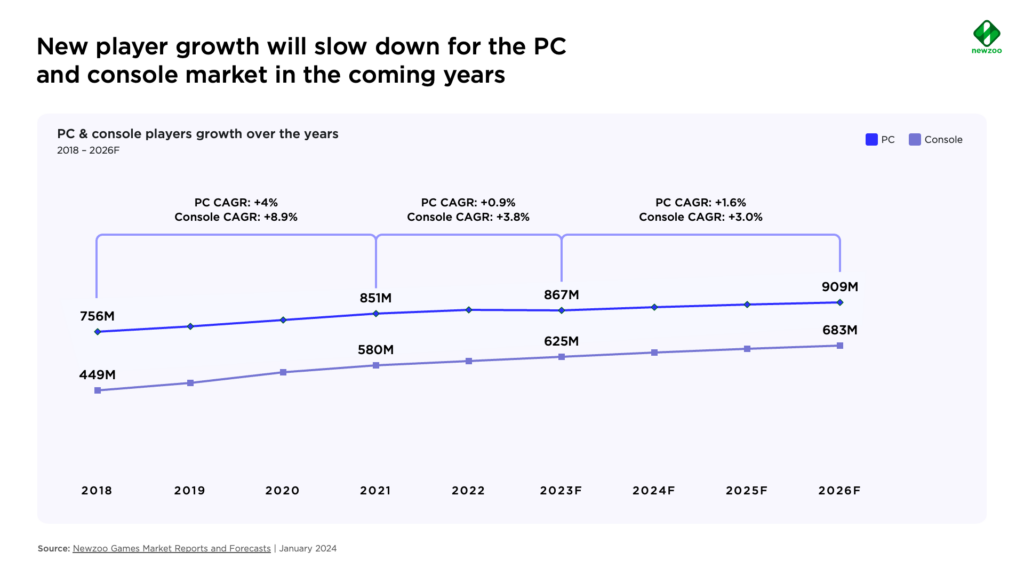

According to the latest PC and Console Gaming report by Newzoo, the PC and console gaming market generated $93.5 billion in revenue in 2023, representing a modest growth rate of 2.6% year-over-year. Despite this growth, indicators suggest that the market is beginning to plateau, with new player growth expected to flatten out in the coming years.

New Nintendo device

Although PC gaming showed the highest growth last year it’s expected that console gaming will emerge as the primary driver of growth in the coming years. The market will grow by a forecasted $14.1 billion from the end of 2023 to 2026, a more conservative growth outlook than before the pandemic. Most of the growth will come from an expanding console install base and the rumored new Nintendo device.

The prevalence of games-as-platforms, epitomized by titles like Fortnite and Roblox, presents a formidable hurdle for new entrants. With established players commanding a significant share of playtime and revenue, newcomers must contend with stiff competition for a slice of the pie.

Playing less and less

Furthermore, the gaming community is witnessing a shift in playtime dynamics. Hours spent gaming are on the decline since reaching their peak in 2021. After the pandemic, players have been playing less and less. This has resulted in a decrease of -26% of average quarterly playtime from Q1 2021 through Q4 2023. Looking forward into 2024, the trend will likely continue as playtime in January 2024 is down -10% year-over-year.

Despite these challenges, there are still opportunities for developers willing to innovate. You can find common success factors between hit games to understand what contributed to their impact. Games rebuilt familiar core gameplay loops into compelling experiences, bringing in fans of multiple genres and franchises (like Palworld’s ‘Pokémon with guns’). Early Access is a popular route as it shows willingness to listen to the community. Finally, social elements and virality also play a large part in many breakout games’ success.

Having said all that, Newzoo comes with the shocking revelation that 90% of new game revenue in 2023 was captured by just 43 titles. Premium titles accrued 32% of new title revenue despite accounting for only 16% of the playtime while 47% of new title revenues came from annual releases.